The lender has had large evaluations of individuals to possess providing an excellent solution shortly after a loan is in techniques

- Transparency: The fresh lender’s webpages states you can see the pricing anonymously. Although not, that is simply correct for the 15-12 months and you can 30-12 months fixed mortgage prices.

- Device alternatives: AmeriSave has no exclusive financing products and zero second-financial re-finance loans to really make it stay ahead of other low-bank lenders.

- Website: New web site’s Education Cardio, that has educational blogs on to invest in and you can investment a home, has never typed another type of article because the 2018. Therefore, it fails to echo alterations in the business at that time.

- Customer care accessibility: Customer care staff are merely available of the mobile Monday thanks to Tuesday, of 8:00 a great.meters. in order to 5:00 p.m. Ainsi que. Nights and you can week-end accessibility do best serve consumers.

Evaluate several lenders very first

To find the best home loan company to you, take the pointers among them and other AmeriSave Home loan Corp. evaluations under consideration whenever gonna lenders. Make sure to browse a lot of loan providers before going to a last choice. After you pick a performance and lender you happen to be happy with, apply for a home loan and you may consider securing in your price.

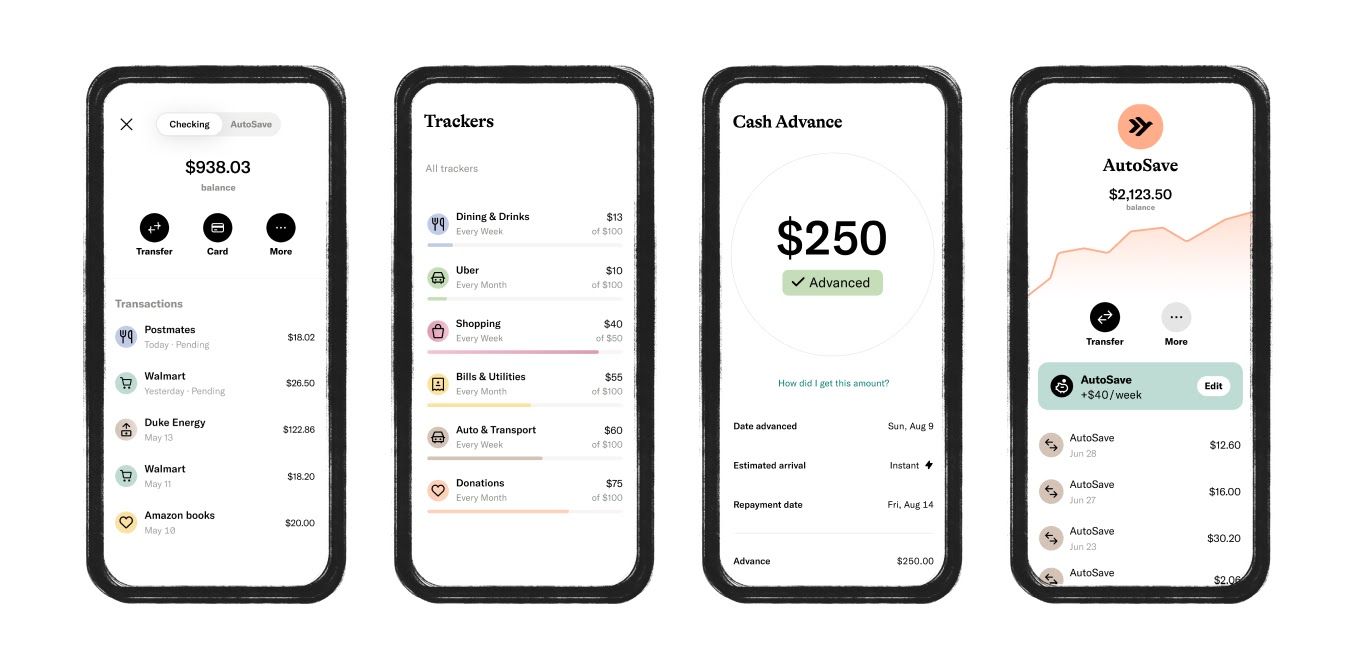

Although AmeriSave isnt a spouse loan providers, Reliable allows you for you to find the best home loan price out of different lenders from the comfort of all of our site. You get your rates in just 3 minutes. Once you’ve picked your loan, you might pertain and you will work through the entire financing techniques best with the the system.

Daria Uhlig is actually a factor so you’re able to Reputable which covers home loan and a home. Their own performs provides starred in products like the Motley Deceive, United states of america Today, MSN Money, CNBC, and you will Yahoo! Financing.

Mortgage lender Recommendations:

- AmeriSave

- Lender off America

- Most useful Home loan

- Caliber

- Carrington Mortgage Functions

Examine Alternatives:

Credible Operations, Inc. NMLS ID# 1681276 | NMLS Consumer Supply | Licenses and you can Disclosures Your website was protected by reCAPTCHA and the Google Privacy policy and you may Terms of service incorporate.

The interest costs portrayed on Credible portray brand new Annual percentage rate. The fixed rate of interest is set during application and will not alter during the lifetime of the loan. New variable interest rate is actually computed in accordance with the step three-Times LIBOR list in addition to applicable Margin fee. The brand new margin will be based upon their borrowing from the bank investigations during the time away from software and won’t change. To have adjustable rate of interest finance, the three-Week LIBOR try 2.375% at the time of . Pick College loans usually to switch the interest rate every quarter on each January step one, April step 1, July step one and you can October step 1 (the interest rate changes day), in accordance with the 3-Month LIBOR List, authored regarding Money Cost area of the Wall structure Road Log fifteen months prior to the rate of interest change day, credit personal loans in HI circular to the new nearest you to-eighth of 1 % (0.125% or 0.00125). This could result in the monthly premiums to boost, exactly how many payments to boost or both. Please visit to find out more regarding the rates of interest.

Varying rate, in accordance with the that-times London area Interbank Offered Speed (LIBOR) had written from the Wall Street Record for the twenty-5th go out, and/or next business day, of your before calendar month. At the time of , the only-day LIBOR rate try dos.10%. Variable interest levels range from 4.07%-% (4.07%-% APR) and will fluctuate along side label of one’s mortgage which have transform from the LIBOR speed, and can are very different considering appropriate terms, level of studies made and you can exposure away from a good cosigner. Repaired rates of interest cover anything from 5.25%-% (5.25% % APR) based on appropriate words, number of studies generated and you will visibility of a beneficial cosigner. Reasonable costs found needs application having an excellent cosigner, was for eligible individuals, want an excellent 5-season fees name, debtor and make arranged repayments while in school and can include the Loyalty and Automatic Commission discounts out of 0.twenty five fee circumstances for each, as the detailed about Loyalty Discount and you can Automated Commission Dismiss disclosures. Susceptible to a lot more conditions and terms, and you may pricing was at the mercy of alter when without notice. Such as changes will simply apply at programs pulled following effective day of change. Take note: Due to federal legislation, People Lender is required to provide the prospective debtor having revelation guidance in advance of it make an application for a private student loan. The latest debtor will be provided that have a loan application Revelation and you may an enthusiastic Acceptance Disclosure in the application techniques just before they accept brand new conditions and you can requirements of the financing.

0 Comments