Just how your credit rating affects their home loan

We all know you happen to be supposed to provides a good credit score to find an excellent mortgage. Exactly what is good borrowing, and just how far can it impression the loan overall? No matter if your credit score is not the only monetary metric made use of to choose just how your own financial is actually arranged, it is a key point in the act.

What’s a good credit score as well as how will it feeling your rates?

Your credit rating stands for the creditworthiness and you may suggests loan providers the risk they will certainly suppose once they accept you for a financial loan. Loan providers can simply imagine your own quantity of upcoming credit risk centered for the earlier behavior and view just how probably youre to repay that loan.

Fair Isaac Business (FICO) is actually a data statistics company you to calculates https://paydayloancolorado.net/palisade/ your credit score created into information on the credit history. Most lenders use your FICO rating when deciding if they would be to agree your for a financial loan.

The new get is not a predetermined number and you will varies sporadically into the reaction to alterations in the borrowing passion. Data is utilized from all of these four classes to determine your own FICO score:

Credit ratings range from 300 and you will 850. For which you fall in this diversity should determine how much cash of a risk you are to help you a lender. If the credit score increases, your exposure height erica is 711, and you can a good credit score was ranging from 670-740.

Your credit score personally affects your own financial rate of interest. You can get acknowledged for a loan with a variety out of credit ratings and you may down-payment combos. Nevertheless highest your credit score is, the greater number of positive their rate of interest will be.

Lenders have confidence in credit scores to indicate just how more than likely a debtor is always to pay off that loan completely. Whenever loan providers is confident a borrower tend to pay the mortgage fully as well as on date, they charges a reduced interest rate.

If you have a reduced credit score, you might still be able to get accepted for a financial loan. But not, the lending company tend to charges a top interest to make sure a beneficial come back on their money.

The difference on your own credit history by yourself may cost $ significantly more four weeks and you can $67,576 moreover living of the financing.

Your credit rating along with has an effect on the expense of the home loan insurance policies. In case your downpayment are below 20 percent, you have to provides individual home loan insurance coverage (PMI). PMI will cost you consist of 0.5 % and 1.5 percent of loan amount. Should your credit rating was low, you will be investing a high PMI matter.

Tough and you will smooth borrowing from the bank checks

Mellow credit checks is a check on your own credit who’s got no influence on your own score. Given that a mellow have a look at doesn’t change your credit score, you might over one to as much as needed.

A challenging credit check happens when a financial institution monitors their borrowing from the bank and come up with a lending choice. A hard consider will lower your get by a number of things and you will remains on the credit file for 24 months.

From the Semper Mortgage brokers, you could potentially receive a pre-approval observe how much money you could potentially acquire additionally the cost your be eligible for by the doing a silky credit assessment.

If you have already completed an official financial application, it does need a challenging credit assessment. However, just after a painful consider try taken, you have forty five months to complete multiple credit monitors with out them affecting your credit score.

How exactly to replace your credit history

There’s absolutely no incorrect time to work towards boosting your credit score. While some one thing take time to eliminate from the borrowing from the bank reports, there are lots of things you can do to start improving your own credit now.

Make money promptly. Percentage record is the premier cause of determining your credit rating, this is why and make timely costs is indeed critical. Place a system in position to quit later payments at all will set you back.

- Would a magazine or electronic system to monitor monthly debts

- Place alerts to have due dates,

- Speed up costs repayments from your financial

Never maximum out your levels. Don’t use more 31% of one’s readily available investing restriction on the credit cards.

Keep the oldest borrowing accounts open. Do not romantic older credit lines after you pay them regarding. It may boost your borrowing from the bank application ratio and you can perception your credit score.

Check for problems on your credit history. Consult a copy of one’s credit history about three significant credit reporting agencies: Experian, Equifax, and you will TransUnion. You may be entitled to a free of charge credit file off each one of the enterprises one per year. Considering a different research of the Individual Profile, 34% of people claimed interested in one error inside their borrowing from the bank records.

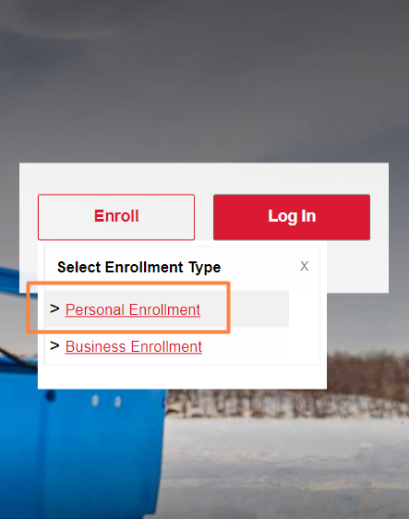

Talk to a loan manager or implement online

If you have questions regarding your credit score and you may exactly what rates you be eligible for, reach out to a loan officer anytime to go over just what financial is right for you. You can also begin the application on line today.

0 Comments