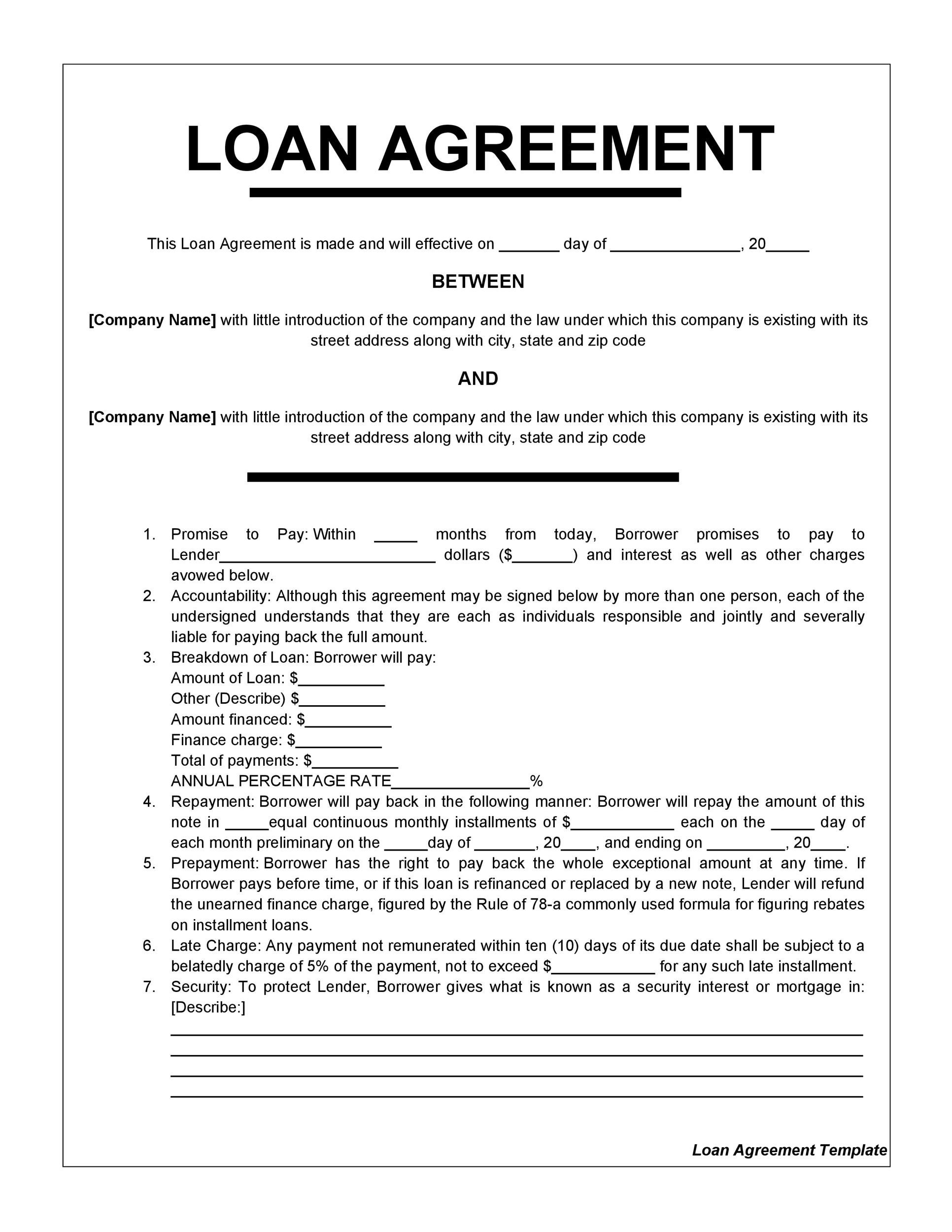

Brand new Effect away from Home loan Troubles with the Credit ratings

Observe exactly how victims which have high credit scores grabbed offered to fix its brand new credit history

- Chapter 7 Personal bankruptcy: You ought to hold off three years from the launch day before applying for a good USDA loan. If you can prove extenuating products, this is certainly reduced to 3 years.

- Section 13 Personal bankruptcy: Consumers need hold off 3 years to take a beneficial USDA loan after their launch time. However with extenuating factors, a debtor can be eligible for a good USDA financing shortly after 12 months of repaying the bills.

- Foreclosure: It takes 36 months just before borrowers takes a USDA financing whether they have a property foreclosure number. not, you can not just take a good USDA loan once more if the foreclosed domestic are backed by an excellent USDA home loan.

- Small Purchases: When you yourself have a credit score off 640, and you can you have made timely costs before the quick deals, it requires no wishing big date, or wait up to a year. But not, whether your credit score is actually lower than 640, they will take 36 months for a debtor locate a beneficial USDA financing.

- Action rather than Property foreclosure: Consumers having fico scores below 640 need certainly to hold off three years having an effective USDA loan immediately following a sipping an action rather than property foreclosure. People with a credit score from 640 and you will significantly more than generally speaking manage not need to waiting, or take one year to acquire a USDA loan.

When you yourself have a property foreclosure or brief marketing record, USDA-sponsored lenders features specific legislation to possess mortgage application. In particular, whether your foreclosed family is actually backed by an effective USDA loan, you simply cannot be eligible for a USDA mortgage once more. More over, you’re not eligible for a USDA money loans Moodus CT loan for folks who took a preliminary profit on your top home purchasing a better home than simply their small-profit property.

Credit score Wreck and Peace and quiet

So you’re able to be eligible for home financing once more, initial action is always to alter your credit score. The full time it will require to fix fico scores may vary for every individual. However some property owners get recover in two age with patient loan costs, anyone else enjoys a more difficult big date balancing numerous debt obligations. So if you’re fresh to budgeting and you will prioritizing big expenses, you will certainly get a hold of debt cost tough. Basically, the greater your credit score, brand new stretched it will take to recoup if you knowledgeable a good shed on your credit history.

Along with lease, living expenses, and a car loan, have you high credit cards you will be unable to spend. Paying back highest bills, of course, is a lot easier said than just over. But as long as you’re making the proper tips so you can rearrange your finances, your role need to have ideal. Eventually, the time it needs varies according to brand new the total amount of the bills as well as how in the near future you can target them.

In 2011, a good FICO analysis compared different types of borrowing from the bank destroying facts, such as for instance 29 to help you 90 date later repayments, bankruptcies, small conversion, and you can foreclosure. The study sampled borrowers you to definitely come with assorted credit scores: Fair (680), An effective (720), and you may Excellent (780). According to simulation’s performance, this new the amount of ruin due to financial difficulties is highly oriented to the an excellent borrower’s initial credit score.

People who have highest initially fico scores tend to have credit ratings you to miss straight down. They also capture a lot longer to recoup than others which have lower credit scores. According to borrower’s 1st get, the fresh data recovery could take 9 weeks (for 30-time later money) so you can so long as a decade (getting personal bankruptcy). According to FICO’s analysis, the second tables show exactly how different financial problems impression credit ratings. The outcome presume every variables are held lingering, rather than the profile or delinquencies.

The second desk shows brand new projected go out it took to recoup the initial fico scores. As an instance, immediately after a bankruptcy, you aren’t an excellent 680 credit rating took 5 years to help you recover, whenever you are a great 720 credit rating got seven in order to 10 years so you can recover. At the same time, you aren’t an excellent 780 credit history got seven to 10 decades to recover. Opinion this new table less than.

0 Comments