Best Personal Lending Book: How to start off

Investing in a property is largely one of the wisest and you can easiest strategies to bring money building. Towards proper base and you may degree, investing home shall be highly financially rewarding for anybody. However, let’s not pretend, you currently understood one to. not, away from brand of appeal is what a trader does toward currency they generate of a successful community.

While you are a fraction of profits will soon be allocated to the new lifetime of the choices, people are encouraged to getting smart the help of its currency. Definitely, you could reinvest towards the an alternative property, but when you require a choice, there is one alternative you haven’t noticed yet ,: individual currency lending.

Buyers who possess the amount of money to do this must look into private money financing inside the home. This step offers the exact same brand of underlying shelter and you can earnings prospective as rehabbing or wholesaling, however, without actually acquiring new attributes.

What is actually Individual Money Lending?

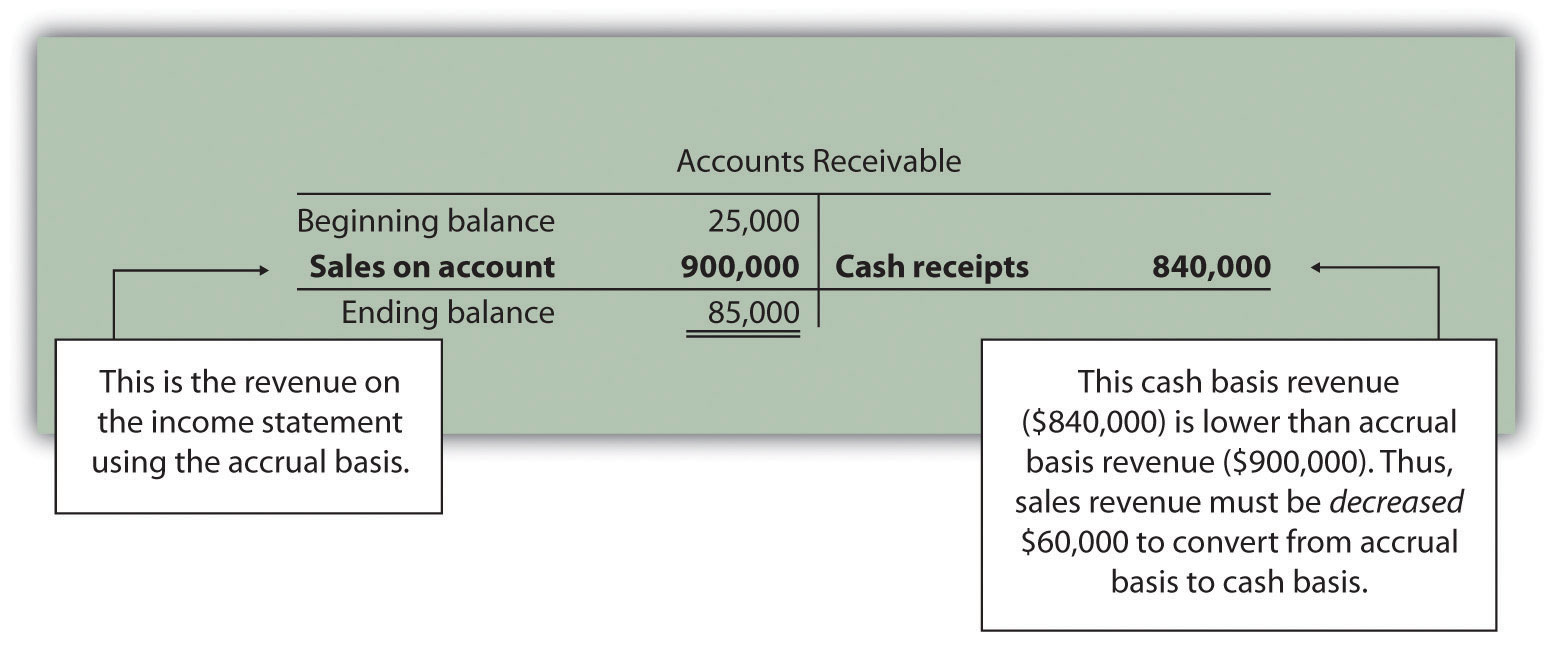

Individual currency lending is when somebody give their unique resource to help you most other dealers or skillfully handled real estate loans if you find yourself protecting told you financing having home financing against a residential property. Basically, personal currency credit serves as an alternative to conventional credit organizations, particularly larger banking companies.

Since the novice people acquire feel, it try and point higher. Leaving their hard-generated profit a family savings isn’t any treatment for manage and you will grow your property. Individual currency lending makes you safe financing which have actual estate really worth a lot more compared to loan. In certain means, this step is going to be safer than simply getting a home. That is why its necessary to get to know a knowledgeable real estate financing possibilities so you’re able to the present investors.

In earlier times, a residential property resource normally originated in banks, government enterprises, insurance vendors, and you will pension money. However, with a list of tight conditions and you can a timeline perhaps not conducive on the average a property investor, a need for option lending source rapidly created. At the same time, it became obvious to the people which have appropriate money one to their money you are going to finest suffice buyers than simply higher establishments. Now, personal currency lending are a critical part of the actual estate capital community. Actually, the visibility helps it be a great deal more simple for an average buyer to help you work at and sustain a lasting profession.

If perhaps you were unaware, there are numerous benefits on it in the event you always give private money. Giving option a home investment selection can also be decrease exposure if you find yourself on the other hand installing wealth when the done right. Definitely, it is not a road for everybody, and you need to ponder if you can manage to exercise. That have a little extra profit the financial institution doesn’t fundamentally imply you should throw it at the basic buyer whom will come your path. When you are supplied to decrease danger and take advantage of one’s options you to definitely promote themselves, private currency financing can get guarantee the consideration.

Who Must look into Private Currency Financing?

Youre a doctor, lawyer, Chief executive officer, otherwise elite group of another form who’s got an excellent earnings otherwise an excess of money.

Nevertheless undecided? Don’t be concerned; the next commonly address questions otherwise issues you no bank account loans Rock Creek Park have regarding the desire a personal currency lending business:

Individual Credit People

Since the individual funds become more common, thus would personal lending organizations. Of several individual financing businesses are groups of dealers which pool the financing to finance even more selling, and increase profits. These firms earn money thanks to attract costs, like old-fashioned loan providers, but they normally have far other app requirements. Of many private financing people perform nearly, and are generally also either called on the web loan providers. Full, they may be one way to finance your upcoming deal.

0 Comments