Student loans And you can Mortgage loans: Your Guide to Purchasing A home When you’re Paying Education loan Loans

Homeownership is actually a major investment decision. For those who curently have college loans weighing off your money, up coming getting a home loan come with a number of even more hurdles. Let’s speak about just how college loans and you will mortgage options work together.

Exactly how Is getting Home financing Some other If you have Figuratively speaking?

Providing home financing which have college loans is the same as delivering a home loan instead of student loans. Precisely what does changes is the https://paydayloancolorado.net/welby/ loans-to-money (DTI) proportion. A top DTI helps it be more difficult to locate good financial.

Very while the maxims of going a mortgage dont change, those with figuratively speaking possess some extra hurdles to face home to acquire procedure . Is a closer look in the techniques homebuyers must go through.

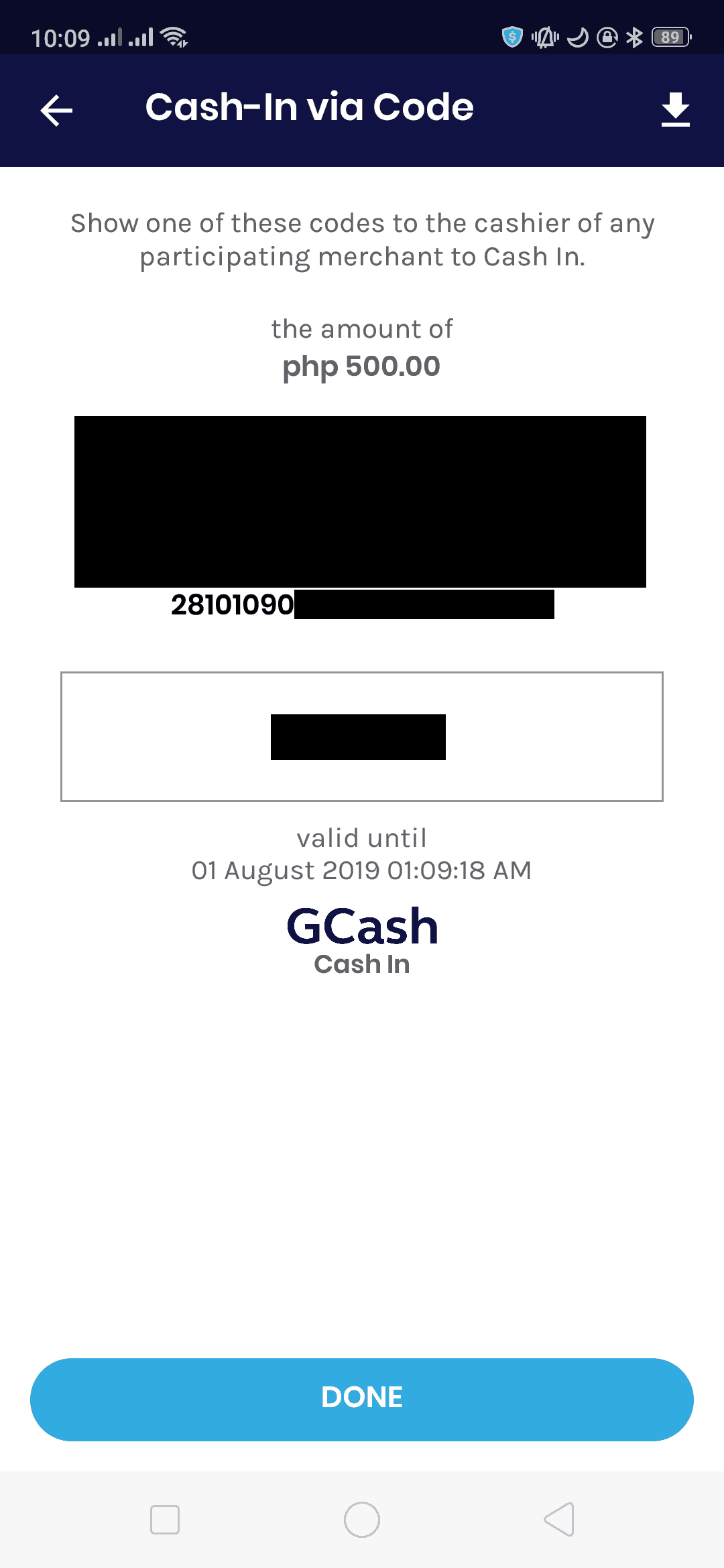

Step one is getting good preapproval . You will need to render details about the money you owe, as well as your student loans, with the lender.

On the underwriting procedure , the lending company will appear at your current financial obligation, credit score , earnings, property and you may recent financial hobby.

Just after looking at the monetary info you considering, the lender often thing an effective preapproval letter while an excellent a beneficial applicant to have a home loan. The lender lets you know how much he could be willing to provide you within file. The amount included lies in a close examination of monetary data.

Whenever you are coping with Rocket Home loan , you will get a proven Approval Page . With this particular document, you could store with full confidence to own house within your budget. As well as, sellers discover there is the methods to pay for the home when making a deal, which will surely help their promote stay except that any someone else.

Shortly after and make an offer utilizing your preapproval page, the house have to appraise at the suitable well worth. From that point, you’ll discover a closing Disclosure on financial, and this information the closed terms of the loan and you may closing costs. If everything looks good for your requirements, then you can signal the loan data at closing.

How come Which have College loans Apply at Buying A house?

For those who have student loans, they feeling your home to get techniques. However, not while the notably as you may think. Purchasing a property that have student education loans continues to be possible for of numerous.

Most borrowers trying a mortgage possess some brand of loans on their guides. Lenders needs most of the most recent personal debt into account by the figuring your own debt-to-income (DTI) ratio. For those who have student loans, loan providers usually factor which in the DTI.

What exactly is Debt-To-Income (DTI) Proportion?

Debt-to-money (DTI) proportion are an option metric you to mortgage lenders imagine. Essentially, your DTI suggests exactly what percentage of their monthly money is utilized to make loans repayments.

With high DTI, it can be difficult to get a home loan. In fact, extremely loan providers are just ready to deal with a great DTI out-of fifty% otherwise lower. But the majority lenders would prefer to pick a lower DTI ratio, to 35% or quicker.

Calculating DTI

First, sound right all your valuable typical, repeating and you will required monthly premiums. A few of the monthly installments you should use in the debt obligations is:

- Lease or newest month-to-month homeloan payment

- Minimum credit card repayments

- Necessary student loan repayments

- Renters’ advanced otherwise homeowners’ top

- Car loan repayments

- Personal bank loan costs

- Court-ordered money such as for instance right back fees, alimony otherwise child service

- Bills

- Market

Essentially, you ought to merely tend to be necessary repayments. When it comes to figuratively speaking, you really need to just through the minimal required commission you must make every month. Thus even although you enjoys $ten,100000 inside the student loan loans, when your payment is just $a hundred, this is the count you should use in their DTI data.

0 Comments