What you should Look for in a home loan company

Loan providers have to meet the licensing criteria to operate on the county in advance of issuing your that loan. The fresh NMLS Capital Cardiovascular system try a gateway towards the All over the country Multistate Licensing System and you will Registry (NMLS), which offers details about licensing standards for every single condition.

From this point, there are also a relationship to your nation’s site, where you could look-up licenses to possess licensed loan providers. Listed below are some what things to look for in a home loan company:

The fresh new Government Housing Authority backs fund to customers maintain the fresh savings good

- Digital lender instead of stone-and-mortar area. This is simply a point of liking. Would you as an alternative try everything on the web or do you including the concept of talking-to some body that-on-one every step of your method?

- Borrowing connection as opposed to other lenders. A card commitment is an effective nonprofit institution with the purpose of getting fund and you may banking properties to people. That it configurations you can both advance pricing than simply that have some other brand of business.

- Present memberships. Check your memberships. The bank may offer a different deal to members. For those who qualify for a cards union membership throughout your company, check out the costs, as well, and evaluate them to what other loan providers have to give.

- Customized service. A proper lending company would be to bring customized solution, providing you with a loan officer exactly who sees you through the entire processes.

It is additionally vital to you will need to reduce interest rates and you will fees. Here are some ideas to save you money because the you are wanting a loan.

This new Government Houses Power backs fund so you’re able to consumers keeping the economy solid

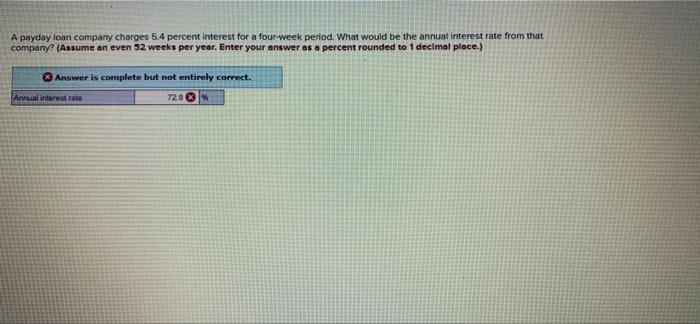

- Financial interest percentage is calculated given that an apr otherwise Annual percentage rate. An apr has the new costs the financial institution costs, because interest rate is only the portion of the primary the financial institution intends to charge a fee to your loan, instead the individuals most costs extra. Perhaps the littlest percentage you can save initial can add up historically you might be paying into the loan.

- Before you start looking, search interest levels to make certain that you’ll know in which a deal stands when compared to the average. The consumer Financial Safety Bureau brings a tool one allows you to find averages for the condition, mortgage particular and you can credit rating height.

- Once you close in your domestic, you will see a summary of fees, entitled closing costs. Settlement costs certainly are the fees billed of the bank and you can closing team in order to procedure you buy. Consult with for each and every lender to inquire of what those costs would be.

There are also multiple programs that will help save a little money, especially while https://www.cashadvancecompass.com/installment-loans-mi/kingston the a primary-day homebuyer. Using this type of 1st pick, you will have accessibility software that can assist with closing costs and much more reasonable costs. Look for a loan provider that actually works with our programs.

Government entities can also help your, not just along with your 1st get however with then purchases. Shop for a loan provider that offers FHA loans and you can rates their cost in comparison to exactly what you might pay money for a conventional mortgage.

When you are an experienced, you can also qualify for an effective Va mortgage, that can render numerous positives not available so you’re able to low-pros. Once the only a few loan providers render these types of choice, in the event, you may have to increase your search.

Brand new Government Housing Power backs money so you’re able to people keeping the fresh new economy strong

- If you are implementing a primary schedule, you ought to basis so it into your decision. Many lenders will say so that no less than 30 days, but if you might be transferring to a special town and/or supplier wants to submit one thing rapidly, it can be in your favor to work with a loan provider that will rates one process right up.

- Some loan providers bring quick pre-recognition online, while others wanted a far more involved process. Regardless if instantaneous approval would be easier, you’ll find advantageous assets to to be able to miss documents of from inside the person, such as the capacity to manage someone to answer the question, just how much domestic do you really pay for?

0 Comments