End up being a citizen that have a 500 credit score mortgage

You might become a citizen having a 400 credit history home financing because of the dealing with an FHA Lender. The new Government Casing Government (FHA) ‘s the prominent insurance carrier off mortgage loans towards the solitary family unit members and you may multifamily house.

FHA may someone acknowledged to own a four hundred credit rating family financing because they bring financial insurance policies to the lenders from FHA-approved loan providers. Because the first in the 1934, brand new Government Homes Government possess insured over 47.5 million qualities.

Whether you’re a first and initial time homebuyer or need to refinance your own existing financial, the FHA loan system tend to assist loans a home having a five hundred credit score and you will the lowest deposit ranging from 3.5% to help you 10% right down to purchase a property.

- To own credit ratings anywhere between five-hundred and you may 579 need certainly to place no less than 10 % off.

- To possess credit ratings between 580 and you may a lot more than you need to set during the the very least step three.5 % off.

FHA mortgages require faster deposit than simply a classic antique home loan. Antique loans wanted 20 percent deposit that will be a great grand burden to have very first-day homeowners.

Such as for example: An excellent $three hundred,100000 house in the 20% down payment means you need $60,one hundred thousand (along with other closing costs). By comparison, an enthusiastic FHA financial would need between step three.5% to ten% getting an advance payment, which comes over to $ten,500 to help you $29,000.

But discover most expenses when you lay below 20 percent upon property. The true expenses of FHA home loan is dependent on the financial insurance fees.

2. FHA financing require financial insurance fees.

FHA’s effortless being qualified conditions and low down fee requirements feature a fees. You need to pay financial insurance fees to afford lender toward reduce fee.

Since the regulators usually right back FHA mortgages, it generally does not do so free-of-charge. Financial insurance costs shelter the expenses with the backing by way of initial and yearly financial insurance costs.

- Upfront premium: step 1.75 % of one’s loan amount, repaid in the event the debtor contains the mortgage. The brand new premium might be rolled towards the financed loan amount.

- Yearly advanced: 0.45 per cent to at least one.05 per cent, depending on the financing identity (fifteen years against. 30 years), the loan matter in addition to 1st financing-to-worth ratio, or LTV. It superior matter are divided because of the a dozen and you can reduced month-to-month.

That means for folks who use $300,one hundred thousand, your initial home loan advanced was $5,250 and your annual advanced create consist of $step one,350 ($ monthly) so you’re able to $step 3,150 ($ 30 days).

step three. FHA has a max loan amount that it will insure.

Low down fee standards and you will aggressive low mortgage rates of interest does not always mean you can get a residence. FHA possess mortgage constraints. New FHA mortgage limitations trust what an element of the nation you live in. Particular components are appointed highest-pricing while others appointed lowest-costs.

These financing restrictions is actually calculated and you will upgraded a year. They’ve been determined by types of house, such as solitary-relatives, duplex, tri-plex otherwise five-plex and you can area https://cashadvancecompass.com/personal-loans-oh/riverside.

- The latest FHA limit loan amount for what the FHA deems high-prices ily land.

- The greatest FHA loan you can purchase in what it phone calls an excellent low-costs ily home.

cuatro. How to make the most of an enthusiastic FHA Financing.

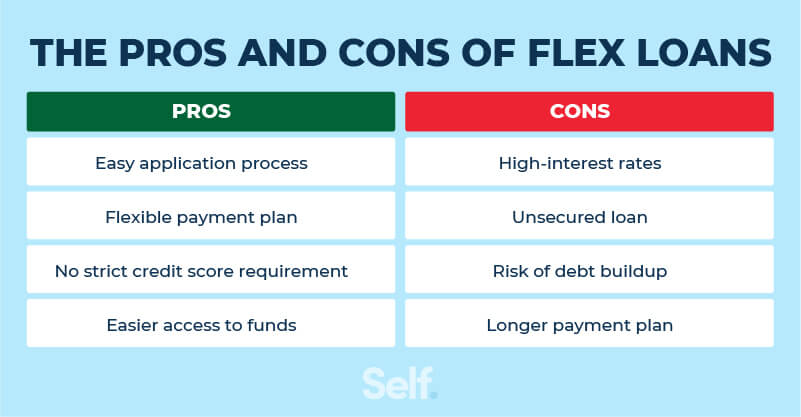

Smaller Stringent Qualifications FHA brings home loan programs with convenient conditions. This makes it possible for very borrowers so you’re able to qualify, also people with suspicious credit history and you can reduced credit ratings.

Aggressive Rates of interest Usually, whenever an excellent homebuyer possess lowest credit scores, the only real choice is good subprime financial. FHA financing give low interest rates to greatly help home owners pay for its month-to-month property payments.

Bankruptcy FHA finance are available to those who unsuccessful personal bankruptcy otherwise knowledgeable a foreclosure to apply for a loan. Consumers need to wait out the FHA’s lowest time period out-of two age adopting the discharge go out of a section eight Bankruptcy proceeding and additionally any additional amount necessary for brand new FHA bank. It is best to guide you features engaged in reconstructing your own borrowing immediately after bankruptcy and possess newest into the-big date borrowing from the bank account.

Property foreclosure Consumers that have a foreclosure must waiting 3 years before you apply to own an FHA loan. This can be easy as compared to old-fashioned lenders who usually need your to wait eight decades just after a foreclosures. They want to view you was rebuilding their borrowing once foreclosure and managing loans better.

Choosing Credit rating Less than perfect credit isnt always problems when making an application for a beneficial FHA mortgage. There are numerous ways a loan provider can also be assess your credit report. The main would be to demonstrate that you really have enhanced in making money hence any later repayments if you don’t collection accounts was in fact remote case that can easily be fairly informed me.

5. Requirements to own an enthusiastic FHA Loan.

Applicants have to be an appropriate You.S. citizen and must introduce a personal Protection amount. The financial institution commonly establish new applicant’s money and you can credit history, also a summary of possessions and you can costs. If you would like be eligible for maximum capital the fresh new borrower should have a minimum credit history off 580. Consumers seeking a 500 credit history mortgage can still be considered to own FHA money but the amount borrowed was reduced so you can an excellent ninety % mortgage-to-well worth ratio.

Being qualified for a financial loan insured from the FHA will likely be of good use in manners. Since consumers is also meet the requirements having much easier borrowing requirements while having reasonable rates of interest, FHA makes it possible to end up being a resident having a four hundred credit score financial. But, you will find things to do to arrange the borrowing documents to possess a mortgage which can make techniques wade far simpler.

0 Comments