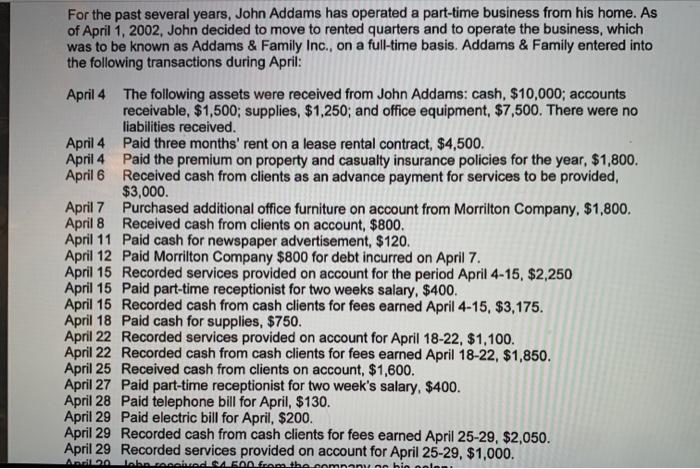

Including, imagine a bank lends $100,000 so you’re able to a great homebuyer

Sallie Mae

These pages was a compilation regarding web log areas we have doing it key phrase. For each and every header is linked to your totally new site. Each hook up inside the Italic are a relationship to a separate key phrase. As the our very own blogs spot has more than step one,five hundred,000 content, customers was basically requesting a component that allows them to read/find stuff you to revolve as much as certain terminology.

1.Government-Sponsored Organizations (GSEs) [Brand-new Blog]

government-sponsored enterprises (GSEs) play a crucial character about thread industry, offering a unique avenue for investors to diversify their portfolios while supporting vital sectors of the economy. These agency bonds, issued by GSEs, are backed by the full faith and credit of the United States government, making them a relatively safe money alternative. In this section, we will delve into the various types of agency bonds issued by GSEs and explore their significance in the bond market.

1. federal National Mortgage association (Fannie Mae): Fannie Mae was established in 1938 to provide stability and liquidity to the mortgage market. It purchases mortgages from lenders, pools them together, and sells them as mortgage-supported ties (MBS) to investors. By doing so, Fannie Mae helps to ensure the availability of affordable housing finance options for Americans. Fannie Mae may purchase this mortgage from the bank, providing liquidity to the bank and enabling it to issue more mortgages to other homebuyers.

2. federal Home Loan mortgage Corporation (Freddie Mac): Similar to Fannie Mae, Freddie Mac operates in the second financial field. It purchases mortgages from lenders, packages them as MBS, and sells them to investors. Read more “Including, imagine a bank lends $100,000 so you’re able to a great homebuyer”