An educated Claims to own Basic-Time Homeowners in the 2022

Regardless if wider a home trend change the whole You, each state possesses its own book factors getting residents. In a few components, the new homeowners find it very difficult to split to your houses sector. In other people, the process is easier.

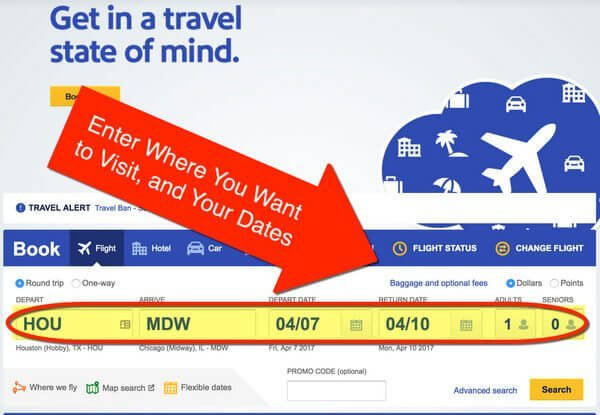

Knowing the top states getting basic-big date homeowners can help you come to a decision if you are considering relocating to buy your basic household. To search for the top urban centers purchasing first belongings, browse issues like the mediocre house price, possessions tax rates, property foreclosure pricing, and you may a wide variety of almost every other metrics. This will leave you a complete understanding of how amicable new place should be to the new residents.The following are the best states having earliest-date homeowners for the 2022:

Rhode Island

At the top of the list of finest says for first-date homeowners is the coastal The latest England state out of Rhode Island. Which have 67% from belongings bought by very first-day property owners, Rhode Island ‘s the county into the largest portion of the industry illustrated of the brand new buyers.

Rhode Isle is the number 1 place for first-date homebuyers once the county is densely inhabited possesses such of job opportunities to possess more youthful benefits. Read more “An educated Claims to own Basic-Time Homeowners in the 2022”