5 selection so you can HELOCs and you can home guarantee funds

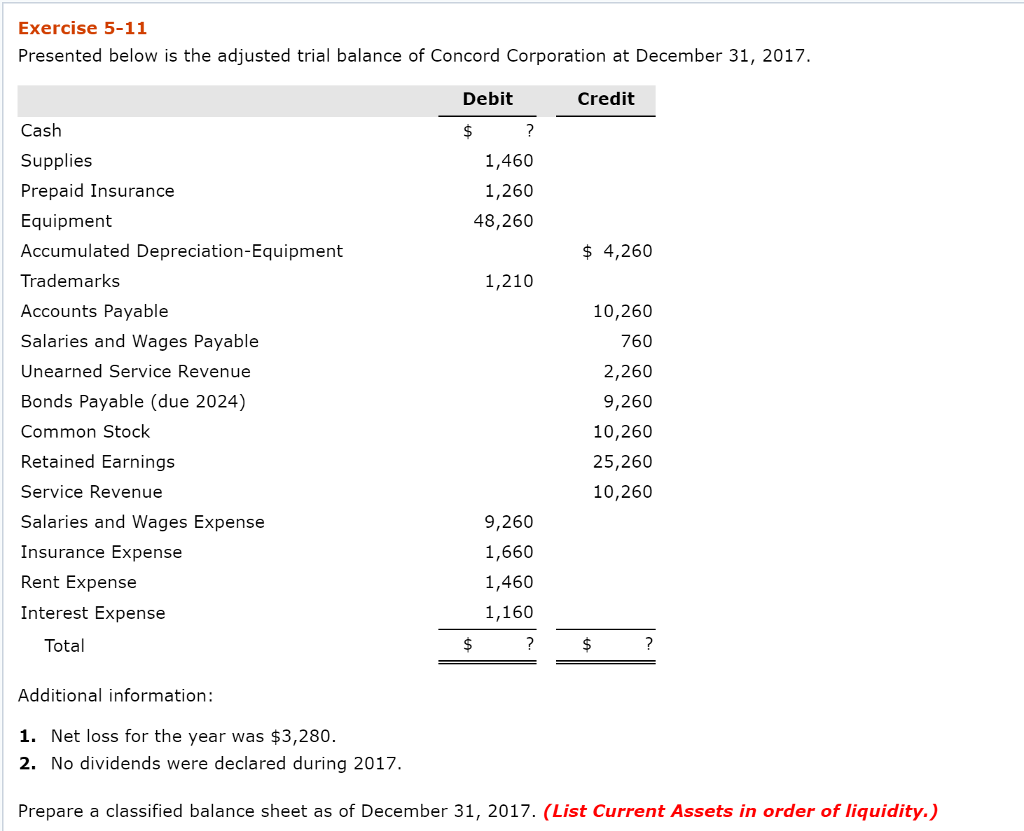

That’s more expensive?

The expense from starting a good HELOC or household equity mortgage is similar, however, rates can differ commonly and impact the overall cost otherwise the loan over every other factor. By way of example, of numerous HELOCs offer glamorous basic costs having six months so you can a beneficial seasons that will be about step one% less than the brand new fixed prices into the house collateral financing.

However, after the introductory several months is upwards, the rate on your HELOC is also jump up with the primary price also good margin – and that ple, should your primary price is 5% as well as your margin is 1.25%, your own adjustable rates will be 6.25%. This may be more than the interest rate into a fixed-rate domestic collateral financing if you locked inside a low rate whenever pricing was advantageous. Read more “5 selection so you can HELOCs and you can home guarantee funds”