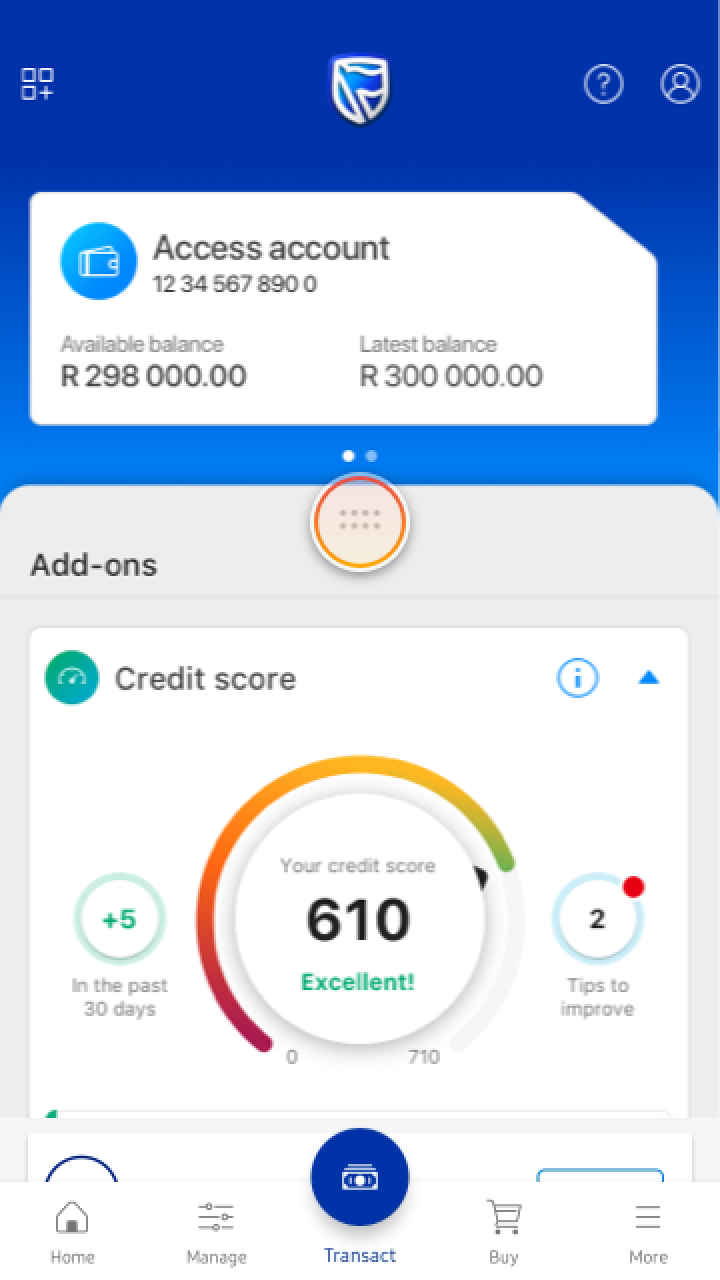

Centered Lenders: HELOCs are given from the reliable financial institutions, along with finance companies and you may borrowing unions performing in the Georgia

These firms, such PenFed Borrowing Partnership, Contour, Relevant Borrowing from the bank Relationship, Delta Area Credit Partnership, Basic Customers Bank, Truist Bank, HSBC, and you can Georgia’s Own Credit Commitment, feel the sense and you can balances to incorporate legitimate financial solutions to Georgia customers

From the offered these types of gurus, people out of Georgia makes a knowledgeable decision regarding the whether or not an effective HELOC aligns with regards to economic goals and requirements. It is crucial for Georgia consumers to carefully remark brand new conditions and requirements instance interest rates, installment possibilities, and you may relevant charges, just before continuing with people HELOC give.

There are many powerful aspects of citizens from Georgia to take on obtaining a house Collateral Personal line of credit (HELOC) to meet up with its monetary need. Check out secret advantages of a HELOC:

- Flexibility: HELOCs provide borrowers for the Georgia an advanced level regarding autonomy whenever you are considering being able to access funds. With a home Guarantee Personal line of credit (HELOC), you have good revolving credit line and this can be tapped for the and if necessary, around a predetermined restriction. This permits you to definitely use and you may pay-off loans as needed through the the new draw several months, giving you new versatility to handle certain economic requirements and obligations.

- Family Security Utilization: Georgia home owners normally control the security he’s gathered for the their homes as a consequence of a beneficial HELOC. Read more “Centered Lenders: HELOCs are given from the reliable financial institutions, along with finance companies and you may borrowing unions performing in the Georgia”