Settling the mortgage very early could save you money in the newest long term

However,, there are many things to consider before you can get it done, along with early payment fees, and you will whether it’s better to pay off https://paydayloancolorado.net/alpine/ other designs out of personal debt very first.

Within publication, we look at the positives and negatives out-of settling their home loan very early, and exactly how you can do it.

Spend less interest

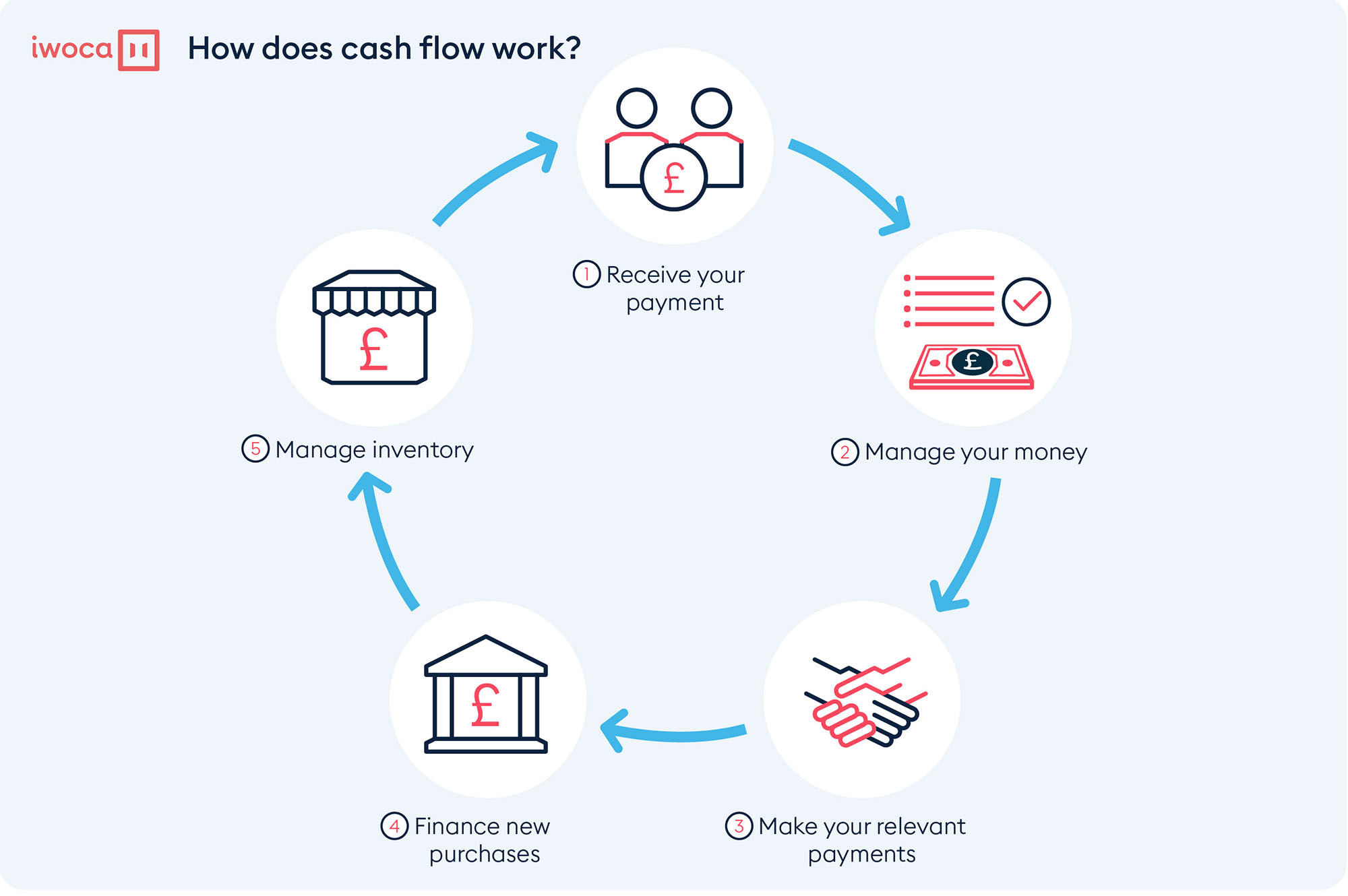

The month-to-month home loan repayments are made up off a couple of additional numbers: the main money you have borrowed, plus attract charge.

This means that more loans you pay out of, the quicker focus possible typically shell out – just in case the pace will not change.

Obvious financial obligation reduced

It means you can pay notice for cheap time, while won’t have to care about the fresh new month-to-month fees requirements for as long.

Get a good LTV (mortgage so you’re able to value)

If one makes significant costs towards your mortgage, it’ll reduce your LTV reduced, just like the number you borrowed from will compress when compared to the property value your residence (assuming their property’s well worth was undamaged).

Such as, if you take aside an alternate repaired-speed mortgage immediately following your existing name closes, you could be qualified to receive down interest rates when you have a lower LTV than before.

What you should watch out for when making overpayments

Just like the advantages of repaying your mortgage early are very obvious, you should think about the potential drawbacks, also, that’ll count on your individual disease.

Overpayment charges and you will early payment costs

These may cost a lot – as much as step 1% otherwise AED ten,000 (VAT exclusive), whatever is lower – making it vital that you browse the conditions and terms of one’s financial along with your bank very first.

Other mortgages allows you to overpay around a share from the an excellent equilibrium on a yearly basis, however, fees having anything else.

That have a keen HSBC mortgage, you could overpay up to 25% of a great harmony for each and every season. Some thing over it tolerance constantly incurs a keen overpayment fee.

You can check your mortgage’s costs regarding the conditions and terms of one’s agreement. When you find yourself being unsure of, consult with your financial provider before generally making a choice.

Pay most other loans first

When you have other outstanding financial obligation alongside your mortgage, such as for example an enthusiastic overdraft, personal loan or a credit card, it could be best to obvious this type of earliest.

Home loan rates are generally less than other sorts of finance, as mortgage is actually secure facing your residence and terms and conditions are much expanded.

When you find yourself purchasing a top interest rate with the loans elsewhere, you may also prioritise purchasing that out of very first however, definitely nonetheless match their minimum financial payments.

Rescuing to own a crisis money

You will need to remember that most mortgages won’t create that re also-mark funds from your loan after you have repaid they straight back.

Unforeseen monetary costs, like house solutions or being required to improve your vehicle, can be spiral out of hand when you’re forced to borrow cash at high rates to generally meet very important repayments.

Thus, if you don’t have an urgent situation loans readily available, you should know building one prior to overpayments towards your financial.

An excellent rule of thumb would be to have 3 to 6 weeks from living will set you back saved since an urgent situation finance.

Most other savings and investments

Perhaps as financial obligation-totally free is not the main monetary mission. If that’s the case, you might thought putting your extra cash inside a beneficial offers or funding membership unlike paying off the mortgage smaller.

You can improve production than what might reduce repaying interest, and you will continue to have easy access to your finances in the event the your necessary it (dependent on everything buy).

Or, you could potentially also begin protecting to the a deposit towards the next possessions to help you act as an investment and rental source of income.

You will need to consider the benefits and disadvantages of each solution, but keep in mind that assets can one another fall and rise for the well worth, so you could generate losses.

How can you make overpayments with the mortgage?

You may either generate a lump sum payment, or enhance your Head Debit so you will be investing a little significantly more for every day.

Boosting your month-to-month Head Debit makes you steadily pay-off their mortgage early without the need to spend a big amount of cash in one go.

0 Comments