Digital house-supported mortgage loans assist household people explore its crypto holdings once the guarantee

The fresh new crypto boom has generated fortunes for some, and lots of ones need to purchase a property that have their brand new riches.

There are numerous examples of real estate developers that eager to just accept cryptocurrencies just like the fee, however for particular crypto traders, attempting to sell the electronic assets was a zero-go.

Past August, United Wholesale Financial, the next-premier mortgage lender on U.S., revealed a want to initiate accepting bitcoin payments, but backed off a few weeks later on.

United Wholesale Mortgage’s reverse, although not, don’t scare this new professionals from delivering mortgage loans towards the crypto industry, since some lenders are rolling out plans to provide crypto-backed money specifically for homebuyers.

How crypto-recognized mortgages functions

To your a higher rate, crypto mortgage loans operate in a comparable vein because dated-designed mortgage loans. The sole difference is that the equity are digital house holdings.

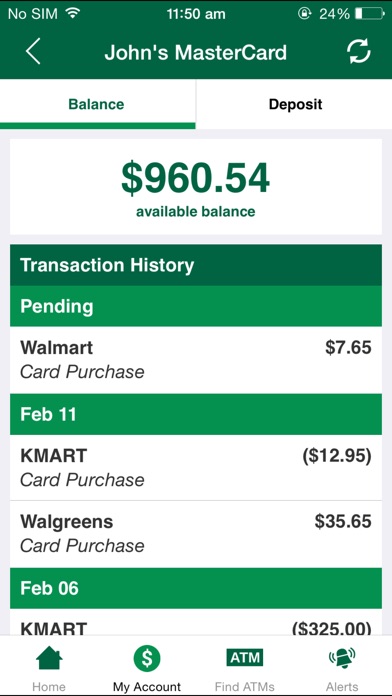

If you take aside a beneficial crypto financial, the financial institution very first inspections your own crypto holdings to evaluate how much cash you might obtain. This is actually the the very first thing regarding decision, since the crypto lenders won’t always need credit rating and paycheck stubs, though it does not hurt getting the individuals able.

Pursuing the financial establishes new terms just how much you might acquire and also at what annual interest rate you have to vow an amount of your own crypto holdings in order to the lender just like the collateral of loan. Which is constantly comparable to 100% of financing. Eg, the fresh new guarantee was $400,000 property value electronic property to have a $400,000 financing.

After you intimate the mortgage and buy the genuine property, you start trying to repay the loan in monthly installments that will be distributed in the chosen cryptocurrencies or in antique fiat.

While the field expands and you can competition grows anywhere between loan providers to own homebuyers’ crypto money, it’s possible to assume offerings and you will acknowledged digital assets in order to develop.

Where are you willing to get a crypto mortgage

Crypto mortgages will still be a little a unique phenomenon, but you’ll find an increasing number of loan providers that allow homeowners power the electronic wide range. Every yearly fee costs are latest as of the time from writing.

- Milo, a florida-depending startup, produced headlines very early this season for being the first ever to promote crypto-recognized mortgage loans regarding the You.S. getting prospective homebuyers. The business focuses on mortgage loans for real property capital purposes and you can also provides 29-season funds of up to $5 million with prices between step three.95% to 5.95%. Milo doesn’t require a down-payment (the fresh borrower can also be funds up to 100% of your own property’s worth), plus it accepts bitcoin (BTC), ether (ETH) and some stablecoins (USDC, USDT, Gemini USD) since the guarantee.

- USDC.Property even offers crypto mortgage loans in the event you want it real home in Tx. The financial institution welcomes bitcoin, ether, USDC and other cryptocurrencies since the guarantee so you’re able to borrow to $5 mil to have good 5.5% in order to seven.5% Apr. The brand new down payment of one’s crypto mortgage was gamble, thus borrowers accrue interest to your collateral offsetting an integral part of the fresh new monthly mortgage repayment.

- Figure, a new york-established lender, unsealed a hold off number having crypto mortgages as high as $20 mil. They intends to undertake bitcoin and you will ether due to the fact equity and supply 30-seasons repaired rates mortgage loans having monthly equity improvements to own given that lowest away from a yearly rates as the 6%.

- Ledn also provides bitcoin-backed fund within the Canada that will be likely to bring bitcoin mortgages so you’re able to readers when you look at the Canada additionally the U.S. this present year.

Who will be crypto mortgage loans to have?

However it are an appealing option for people homeowners whom possess built wide range mostly stored in the cryptocurrencies and who don’t wanted to market the crypto financial investments.

Professionals regarding crypto mortgage loans

- First, you don’t need to cash out of crypto investments so you can buy a house having a good crypto financial. This is important because offering your own financial investments manage sustain financial support progress fees.

- It will be more relaxing for foreign customers purchasing a house throughout the You.S., just like the crypto financial business always don’t require credit rating and you can a great personal safety number.

- For somebody who thinks their crypto holdings have a tendency to see a great deal more considerably versus price of one’s loan through the years.

Risks and you will drawbacks regarding crypto mortgage loans

The reason a great crypto home loan is not suitable for people try simple: Crypto’s price is highly unstable, which makes them higher-exposure investment.

If you take out that loan at the top of the crypto opportunities, the dangers is compounding. When cryptocurrency markets crash, it lower the worth of the new equity, as well.

- When personal loans for bad credit Chicago the cost of the brand new digital assets you have got set up because collateral drops, the lender need one to add more of one’s financial investments toward equity comparable to an excellent margin get in touch with old-fashioned places. This way, their resource was locked therefore never trading it.

- If the market value of your own collateral falls actually deeper, brand new collector may need to liquidate force sell your assets getting a fraction of the expense of the brand new capital you really have added to it.

Krisztian Sandor

Krisztian Sandor recently graduated regarding NYU’s team and you can economic reporter program as a Fulbright fellow and caused Reuters and you will Forbes in past times. Originally away from Budapest, Hungary, he’s today situated in Ny. He keeps BTC and you will ETH.

0 Comments