Abandon the loan fret: Like interest-only financial or increase the definition of

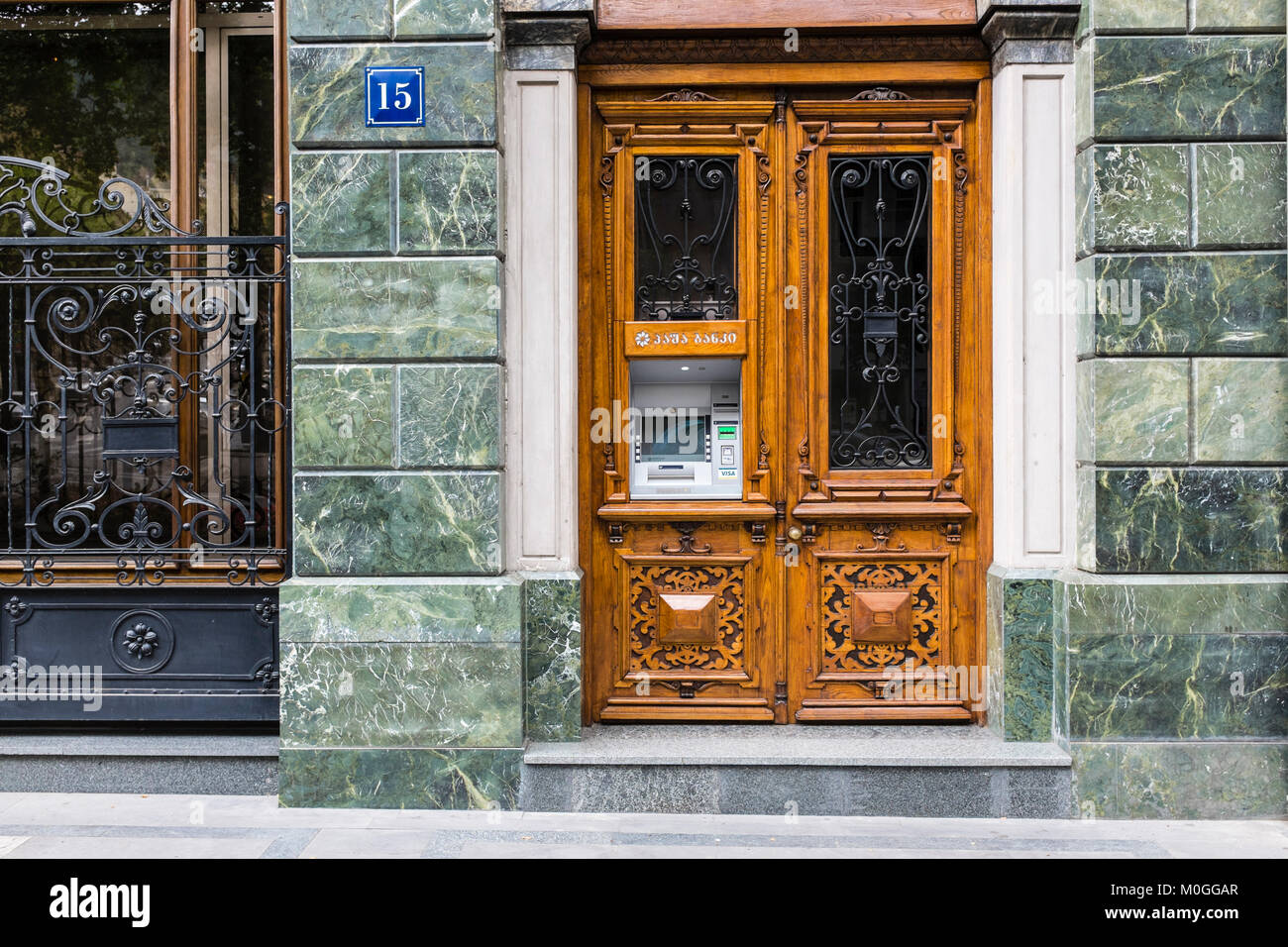

Since the notice-simply home loans and you can term extensions usually are allowed to getting availed for a primary-title period, the primary reason to adopt a person is to reduce their month-to-month mortgage payments to possess a-flat time. Picture Borrowing from the bank: Shutterstock

Dubai: If you’re not able to satisfy their month-to-month payments in your family loan, you may be provided an option to sometimes briefly switch to interest-simply costs or offer your home loan identity. But and that of these selection would you like? Together with, how have a tendency to it affect your credit rating?

While they commonly due to the fact preferred just like the traditional mortgages, interest-only’ lenders are opted for if there’s good cash crunch during obtaining financing. However, you can find dangers inside, explained Abbud Sharif, a financial world expert situated in Dubai.

Repayment mortgages’ was conventional mortgage brokers you to definitely encompass purchasing a-flat matter per month during the course of the loan. The latest percentage constitutes an amount partly used on paying interest (the expense of borrowing), along with the rest getting back together a portion of the lent count (the principal).

Yet not, with attract-just mortgages, you pay precisely the part of desire every month, with the whole prominent amount anticipated to be distributed entirely at the conclusion of the term. Thus, if you learn it tough in order to initially to spend much each month to expend their dues, eg financing are worth given.

How can interest-only’ mortgage brokers do the job?

How long you can only pay the eye piece toward interest-only’ home loans depends on along the financial and you will simply how much you borrow, explained Jose Paul, a keen Abu Dhabi-dependent banker. Immediately after which, just be sure to begin to pay the principal matter owed.

In past times, borrowers possess either successfully paid their interest, but i have after that achieved the end of its loan while having come incapable of pay-off the main count. Thanks to this these money is risky, and exactly why they are often limited with terms of five ages.

Often, your own lender offer the choice to settle part of one’s dominant for the very first focus-simply period. Whether or not you decide to do this relies upon how you decide to get-off the borrowed funds, your financial situation and exactly how useful this will be to you out of an idea perspective.

For people who took a timeless thirteen-12 months fees financial out-of Dtitle million with an intention price from cuatro %, this new monthly money might be Dh6,680. Which wide variety to Dh80,160 a-year. For individuals who got a comparable mortgage matter and you may interest rate, but toward an attraction-only installment basis for the initial seasons, then month-to-month repayments will be Dh2,333.

During the period of per year this should amount to throughout the Dh40,000. In this instance, choosing the attention-only home loan for just one 12 months perform amount to a saving regarding Dh40,000. While this can benefit you the first year, it will not be because useful in the future because of the end-of-name costs for like loans. Besides costs, interest-merely mortgages including have a tendency to need a much higher advance payment.

Exactly what are the risks of attract-merely mortgage loans?

Interest-merely money normally require a bigger downpayment, highest credit rating and a reduced financial obligation-to-money (DTI) ratio than just old-fashioned funds. Your debt you could potentially undertake proportional on the money is an assess https://paydayloanalabama.com/phenix-city/ utilized by loan providers to determine an effective borrower’s power to repay the loan, added Sharif.

When you’re interest-only mortgage loans can be a fantastic choice for the majority of consumers, the high downpayment standards and avoid-of-title costs make them less of an appealing alternative. And, it might not be easy so you’re able to meet the requirements, because you will must prove to the lending company their installment effectiveness.

0 Comments