Must i take a loan for making an EB-5 money?

The EB-5 visa system also offers a route to You.S. permanent residency because of financing. In order to qualify for an eco-friendly cards, an investor need make an enthusiastic $800,000 money from inside the a targeted employment urban area (outlying otherwise high jobless), otherwise $step 1,050,000 in other places, while performing no less than 10 the newest complete-big date work to possess You.S. pros. This choice brings a window of opportunity for people, college students, and parents seeking real time and are employed in the U.S. The latest EB-5 visa system is also popular between anyone staying in the All of us into the low-immigrant really works visas including H-1B, H4, L1A, L2 and you can E2; and you may international students towards the F-step 1 visas otherwise elective standard education (OPT). When you’re interested in learning so much more, excite consider all of our article and you may films collection:

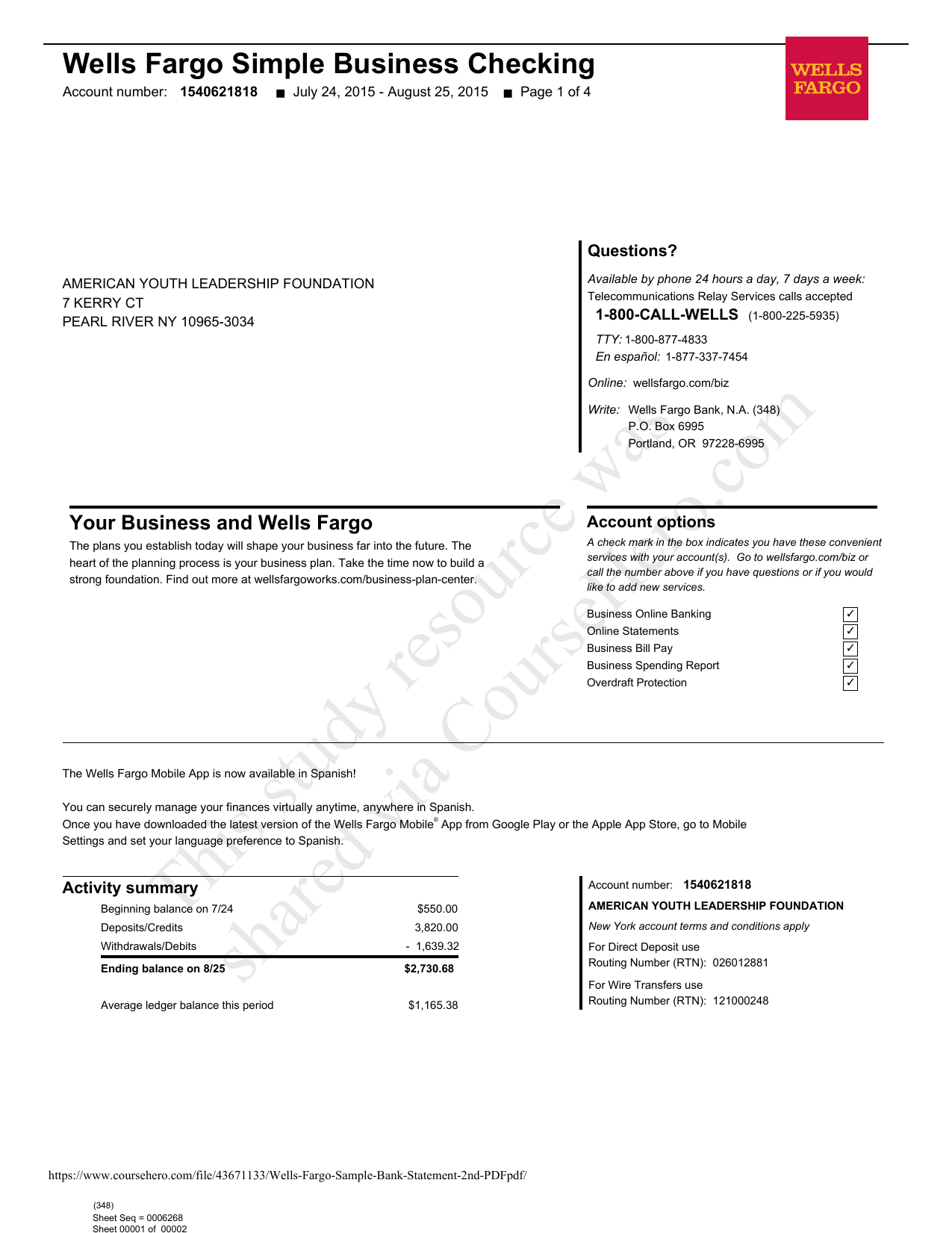

An EB-5 buyer ought to provide facts that the financing employed for the fresh new resource was in fact lawfully acquired, from the recording the source out-of funds. Appropriate sourced elements of EB-5 capital include private savings, sale from property, financing profile, self-brought personal old age membership or SDIRA, a gift, otherwise financing, as well as others.

There are many different financing present getting EB-5 visas, and relatives and buddies, creditors together with financial institutions and you will credit unions, and licensed agencies associated with regional centers. For each and every choice gift suggestions a unique professionals, such as for example easing exchangeability limits, to avoid resource increases fees and you will conquering foreign exchange remittance restrictions. In this article, i explore various indicates traders normally incorporate money getting EB-5 expenditures and you may emphasize the huge benefits and requires of each approach.

Are there loans readily available for making an enthusiastic EB-5 Financial support?

Yes, finance are for sale to making a keen EB-5 money. Various sources, plus friends, friends, creditors, and you will entities affiliated with regional facilities, can provide eg funds.

Qualified EB-5 Financial institutions

- Family & Family: EB-5 people is also safe money away from private relationships, provided the financial institution can also be fully document the foundation of the finance getting USCIS compliance. Fund out-of friends and family will likely be both shielded or unsecured, however, thorough files of the bank acquired the money was crucial.

- Financial institutions: Banks, borrowing from the bank unions, or other monetary organizations provide secured personal loans, have a tendency to backed by assets such as for instance home. Family security finance otherwise line of credit (HELOC) was a famous option, and you will credit unions may offer even more aggressive interest rates than simply antique financial institutions.

Signature loans, if you are you’ll, become limited when you look at the count (always around $50,000) and tend to be susceptible to more strict eligibility conditions according to credit scores and you will financial wellness. Secured personal loans ount for the value of new house protecting they, requiring proper paperwork of one’s resource acquisition to have USCIS.

- Connected Entities: Specific agencies tied to EB-5 regional locations can provide personal loans. Speaking of made to facilitate investment in the event you may not have enough liquid assets otherwise ample credit score or remittance constraints from their domestic regions such as for example away from Asia, China, Pakistan, Vietnam or Myanmar.

Great things about Playing with Funding having EB-5 Investment

Approaching Liquidity Factors: EB-5 traders will often have tall property however, do not have the full $800,000 required for new financing. Fund assist link so it pit, providing people to generally meet the EB-5 requirements while keeping particular liquidity. Including, a trader possess $five-hundred,000 or $600,000 offered but desire fool around with that loan to afford remaining equilibrium.

Sustaining Exchangeability: Buyers might want to hold exchangeability to other intentions, for example private assets otherwise emergencies. Although they can safety the EB-5 financial support matter, that loan allows them to maintain its financial flexibility if you’re still doing the application form.

Avoiding Resource Increases Fees: Specific investors choose money to cease leading to financing growth taxes who are present out-of selling assets. According to the tax effects out-of liquidating property, taking right out that loan ple, repaying financing might be cheaper than attempting to sell a secured asset and you can using quick- or long-name capital increases income tax.

USCIS Filing payday online loan Minnesota Efficiency: Fund, such signature loans, offer easier and you may faster documents to own USCIS. The procedure is often as easy as providing financing approval, animated money, and entry the new EB-5 application. Secured finance, if you find yourself far more inside due to advantage verification, are in balance that have best documents.

Remittance Constraints: From inside the countries having rigorous remittance rules (such as Asia, India, Vietnam, Bangladesh, and you can Pakistan), people usually see it difficult to help you import huge amounts of money abroad. Bringing financing out of an effective U.S.-established organizations normally defeat this type of constraints, allowing the brand new buyer to meet up with EB-5 criteria instead cutting-edge worldwide economic believed.

Tax into the Remittance: Particular countries, instance India, enforce taxes towards the outgoing remittances. India’s Income tax Built-up during the Source (TCS) stands on 20% of your own remittance number. For almost all traders, its so much more good for safer that loan in the U.S. than to remit financing and you can bear high taxation charges.

Even more Considerations

Secured compared to. Unsecured loans: Secured personal loans need detail by detail papers of your own house protecting the borrowed funds, that will complicate the process. Personal loans, however, are easier to file and you can faster to procedure, which makes them a popular choice for EB-5 dealers.

Finance off agencies tied to local stores provide book professionals, for example unsecured loans doing $300,000. Such financing cater to buyers who use up all your significant property or borrowing background. Additionally, they often times have favorable installment terminology, for example a-two- or around three-year term having prominent payment, in which just attention costs are expected. It liberty is specially popular with traders waiting for almost every other provide of cash to be offered, such as for example bonuses otherwise vesting shares, permitting them to slow down complete repayment.

0 Comments