Must i score an educatonal loan if you are I am during the Section 13?

In the two cases, it’s essential to consult your case of bankruptcy attorney in advance of continuing that have one home-associated deals. Might make suggestions through the process, help you prepare yourself the mandatory files, and ensure compliance having bankruptcy laws and you can court tips.

Contemplate, this is exactly an continue reading this over-all publication. If you’re a recent customer and have now issues, try looking due to these solutions earliest; these are generally made to answer regular issues, but your specific disease can vary. For folks who still need help, label any office on top of this site nearby your or email address the paralegal yourself. Our team is preparing to help you; if needed, we are able to create a meeting with your lawyer. Constantly speak to your personal bankruptcy lawyer to own custom pointers.

Whenever in the middle of a part thirteen bankruptcy, you could potentially ponder whenever you however take out students loan. In general, the solution is actually sure. But not, you can find extremely important factors to consider. Here are the standard assistance getting Applications and you can Moves to Sustain Debt.

Section 13 personal bankruptcy, called a wage earner’s bundle, lets people with typical earnings growing a propose to pay all or part of its expense. During this techniques, debtors suggest a repayment propose to generate installments in order to loan providers more three to five years.

Now, with regards to college loans, he’s addressed because nonpriority unsecured outstanding debts when you look at the Chapter thirteen case of bankruptcy. This means they might be on the same top because personal credit card debt, medical costs, and personal finance. During your Chapter 13 bankruptcy proceeding, you will end up and then make costs into your debt considering your own payment bundle, and your student education loans gets a fraction of this type of payments.

However, in the Section thirteen bankruptcy proceeding, you may be according to the case of bankruptcy court’s jurisdiction. The new Part 13 Trustee and/or Courtroom tend to test out your element to settle the fresh new debt, how the degree often alter your income potential, and you will if the the new personal debt usually restrict your current cost bundle.

When you need to incur the latest financial obligation, such as for instance an educatonal loan, you’ll likely need to have the Section thirteen Trustee’s or the Court’s permission basic

Whilst you get figuratively speaking through the Section thirteen bankruptcy, the brand new terminology could need to be more beneficial. Government college student support might still be accessible, however, individual lenders might be far more reluctant, need a good cosigner, otherwise provide higher rates.

Remember, that is a general evaluation; the fresh knowledge can differ considering your circumstances and you can local legislation. While you are a recent customer and possess inquiries, is lookin by way of this type of answers very first; these include built to answer regular concerns, however your specific disease can differ. For many who however need help, label the office towards the top of this site nearby you or current email address your paralegal really. All of us is able to help you; when needed, we could create an ending up in the lawyer. Constantly check with your bankruptcy proceeding lawyer to own personalized guidance.

What exactly do I want to carry out if i must acquire currency for some thing besides a vehicle whenever i in the morning in my personal situation (Student education loans, Mortgage brokers, Almost every other Money)?

Credit Currency during the a part 13 bankruptcy proceeding instance try a subject that really needs consideration. It’s important to remember that when you declare Section thirteen bankruptcy proceeding, you are agreeing so you can an installment plan that continues less than six age. You happen to be essentially just permitted to happen the fresh new loans with the Trustee’s and/or Court’s permission during this time period. This may involve figuratively speaking, home loans, or any other types of money.

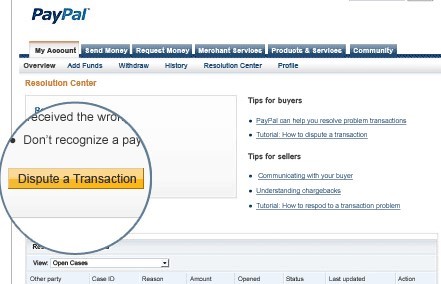

If you want to borrow cash to own one thing besides a great car, you’ll need to experience a system also known as App otherwise Action to help you Sustain Financial obligation. This action concerns looking to recognition regarding the bankruptcy court and you may exhibiting the the loans does not interfere with the constant bankruptcy money. Here you will find the general assistance to possess Applications and you can Actions to Bear Loans for Low-Vehicles.

0 Comments