Securing a mortgage given that an employee Nurse

Lenders try an old-fashioned heap. Banking companies prevent mortgagees towards the trimmings from a top-risk borrower. Whenever appraising potential individuals, they defer so you can reasoning, purchase, defense, shelter, and you may predictability.

Unfortunately, nurses usually do not go with these kinds. Medical actually good cushy nine to 5 jobs on the week-end out of or predictable income. Nights differentials, overtime, variable pay, and work openings determine this new breastfeeding occupation. And it also gets far worse while you are a traveling nursing assistant because income comes with taxable and you may low-nonexempt earnings.

Such as subtleties allow it to be difficult to travelling nurses to qualify for home financing with glamorous terms, whenever. Dig inside even as we discuss legitimate an approach to defeat the problems unique to travel nurses and secure home loan recognition.

Professionals nurses obtain it good-by getting more cash monthly. You could and may leverage it additional shell out to secure positive financial words. New overtime, a lot more changes, and you will shift differentials can lead to a good money hit.

The fresh Breastfeeding Salary

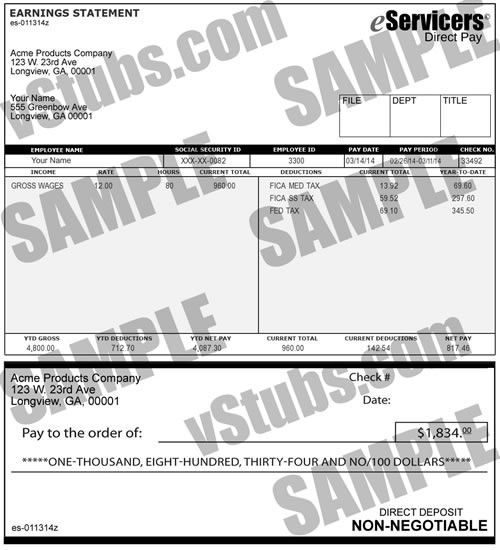

Their income was broken towards the base and even more spend, plus overtime and change differentials. With careful believed, you can make every cent count whenever qualifying getting home financing.

Travel Nursing assistant Base Shell out

Whenever applying for a mortgage, loan providers make use of ft nursing pay since first said. Particular loan providers wanted a two-season a job record in the current income so you can accept home financing. Anyone else are more flexible that will thought breastfeeding university element of your projects record.

Once the medical college or university requires more a couple of years, the latest nursing grads can be eligible for a home loan from date one. Protecting an enthusiastic employer’s bring letter together with your foot shell out and you will days can get you home financing of date one of the nursing field.

Considering ZipRecruiter, an entry-level registered nurse helps make regarding the $30/hour or $61,728 per year. An initial nurse can qualify for a beneficial $200,000 financial from the FHA from the a good step three.75% interest. However, only if your improve a step 3.5% down payment and you can hold lower than $400 various other monthly expenses.

Overtime, Change Differentials, or other Incentives

You might safer glamorous home loan terminology utilizing the a lot more pay using your home loan app. Thank goodness, flexible loan providers identify an effective nurse’s most pay given that changeable earnings. You will need to offer a dozen so you can a couple of years of the extra revenue to matter on qualifying earnings.

Consider an example personal loans for bad credit New York where you have frequently spent some time working night shifts for around couple of years that have a night differential out of $5/hours. You as well as picked particular overtime in identical months.

- Overtime = $450/mo (240 hr more than a couple of years x $45)/? 24 mo

Consequently, a lender can use a beneficial $5,238 month-to-month earnings so you can be considered your home loan. And in addition, the additional Registered nurse spend sets your within the a good status for the financial. It will probably improve probability of being qualified to own home financing and you can snag you advanced conditions.

If your issues cannot go with that it textbook example, you may still come-off on the top. An effective several-times background using this style of earnings get serve. But you’ll need certainly to complement it with a letter out of your employers attesting your money will likely remain.

Sadly, you might not utilize the more income so you can qualify for good home loan should your a lot more shell out history was below 1 year. not, home financing pre-approval could help pave just how submit. An enthusiastic underwriter usually pore via your money documentation and discover the latest earnings you can make use of to try to get a mortgage.

The way you use your own full nursing assistant pay to help you qualify for a good financial

- Provide the lender for the W2 and you will last spend stub off your own early in the day employers for the past 3 years if you’ve recently changed efforts.

0 Comments