Student loan Bucks-Aside Re-finance: Things to See

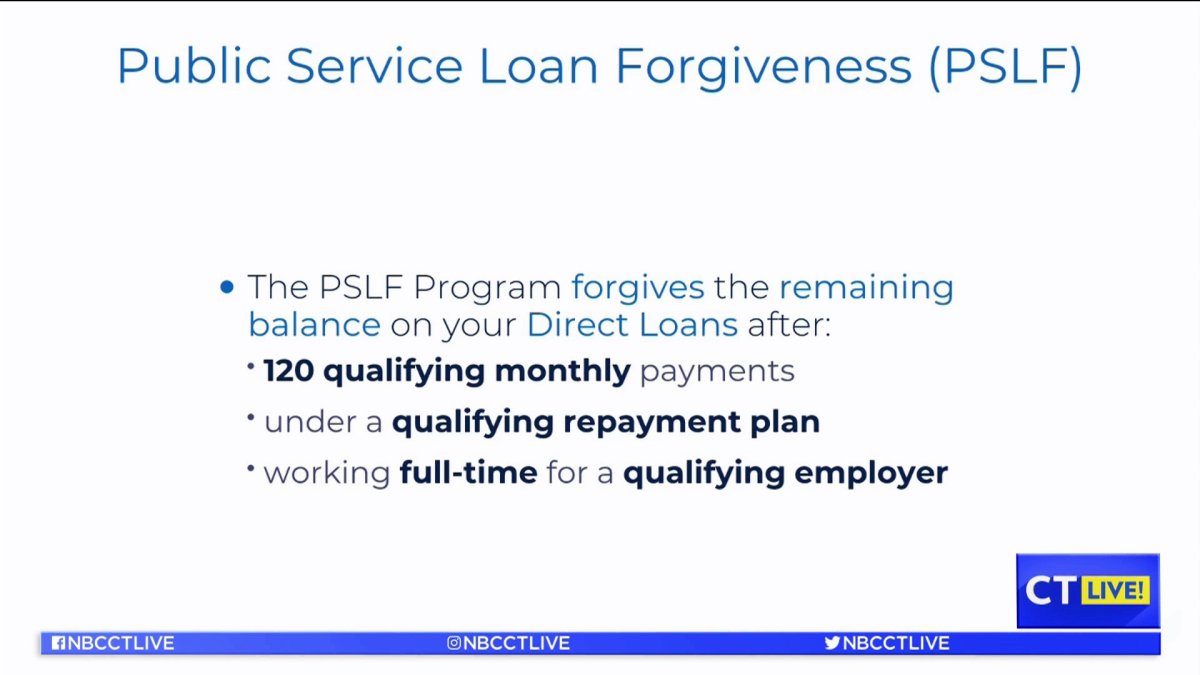

With well over $step 1.75 trillion into the education loan debt in the united states, individuals was looking for forgiveness ventures. Even though some forgiveness exists so you can educators and you may societal servants in the specific positions, such choices are unavailable to any or all, leaving of a lot selecting a remedy.

Student education loans exclude consumers out-of and then make extreme lives behavior, such as setting up a deposit getting a house. Fortunately, individuals looking homeownership can take advantage of an educatonal loan cash-away re-finance system. This method now offers homeowners the flexibleness to settle high-focus student loans if you are probably refinancing so you can a lesser home loan focus rate.

Even though this program actually exactly a great forgiveness program, it will allow individuals to link college loans and you may mortgage repayments into the one percentage at a lesser interest.

In this article, i falter which student loan cash-aside refinance system in order to see whether or perhaps not they is good for the problem.

What’s a finances-Out Re-finance Exchange?

Because 1970, mediocre student loan personal debt has grown from the more three hundred percent. With on average more than $31,000 into the student loan financial obligation for every single scholar, it’s no surprise individuals need education loan forgiveness applications. As well as the programs we mentioned above, this new solutions was growing, such as state financial software that provide particular otherwise overall debt recovery.

Probably one of the most popular education loan rescue selection has been education loan cash-out refinance applications. Such applications are like a timeless cash-away refinance exchange, that allows home loan holders to restore an old home loan having good another one having a bigger count than simply due towards the early in the day mortgage. This will help to borrowers use their residence financial to view bucks.

For those who should pay off college loans, a student loan bucks-out refinance is basically like an earnings-away refinance system, although extra money on the brand new loan pays off scholar financing obligations.

Highlights away from Education loan Bucks-Away Refinance Applications

Student loan bucks-aside re-finance apps ensure it is student loan obligations installment through a home financing re-finance. Becoming qualified, one education loan must be paid because of the giving loans into education loan servicer during the closing.

Extra Uses of the Bucks-Away Refinance

While the pri would be to pay education loan personal debt, the borrowed funds can also be used in other indicates. In case your debtor doesn’t want to pay off the entirety off their student education loans, they could always repay almost every other home loan-related financial obligation. Such as for example, borrowers may want to pay-off:

- A current first mortgage loan.

- Financing to cover costs toward an alternate structure home.

- Closing costs, items, and you will prepaid facts, not including a home taxation which can be more two months delinquent.

- Under liens regularly find the possessions or included in the the fresh mortgage.

In addition, the fresh new debtor ount isnt more than 2 percent of your own the fresh new refinance number, otherwise $dos,one hundred thousand. The brand new borrower may also be refunded by the lender when they accrued overpayment of charges thanks to federal or state laws and regulations otherwise laws and regulations.

Additional information

To get the great benefits of a student-based loan re-finance system, the mortgage have to be underwritten by Desktop Underwriter (DU), an enthusiastic underwriting system you to definitely Fannie mae often spends and you can, in many cases, the new Federal Construction Authority. Though DU cannot choose this type of purchases, it will publish a contact if it appears that figuratively speaking is noted repaid because of the closure. So it message will tell lenders of the mortgage standards, nevertheless bank have to concur that the loan match all criteria away from DU.

Talk to a loan Officer On the Education loan Cash-Aside Home loan Criteria

At the distance, we don’t envision home buying has to be tough. And in addition we dont believe you should have to put your hopes for homeownership toward keep cashadvancecompass.com loans wired to a prepaid debit card on account of figuratively speaking.

Whenever you are curious about a little more about student loan bucks-out refinance choices-and additionally a student-based loan refinance system-get in touch with a Loan Officials. They will be happy to make you much more information.

0 Comments