Auto loan Prices to have a beneficial Car or truck With 650 so you can 659 Credit rating

We come across amazing offers online and on tv for new vehicle loan cost, however, we rarely see used vehicle cost stated. As a whole, borrowers will pay a top interest rate having a good used car mortgage.

Which have a credit score from 650-659, you ought to qualify for a beneficial subprime Apr price, that’s more than somebody that have an excellent 700 or 800 credit rating.

An average rate having an excellent used-car loan in the 650 in order to 659 credit score variety is % (% more than the typical speed to have yet another auto).

Pricing is actually highest for used autos as their worthy of is leaner. In the event the lender needs to repossess your vehicle it may be burdensome for these to sell it having sufficient to protection their harmony. Meaning a lot more chance with the lender. Lenders charges large rates whenever their exposure rises.

Even after higher interest rates, put automobiles can be a good deal, given that they the fresh new car or truck is sometimes reduced as compared to cost of a used-car.

?? Be careful!To order a beneficial car or truck has its own dangers. That is why we need to check the newest automobile’s history. You can manage an automible record writeup on web sites such as for instance Carfax utilizing the Car Character Count (VIN). Should your agent or provider will not offer the VIN, think about this a major red flag and get to various other vehicle.

Average Car loan Conditions to possess a great Used-car

You can view the latest impression of your own higher rates. The real difference, definitely, is that the mediocre business cost of an alternate vehicles during the the united states try $39,960, because the average cost of a beneficial car is actually $22,100000. That’s a big difference!

Vehicle Refinance Pricing Having 650 so you can 659 Credit rating

Should you have a diminished credit history emergency payday loans with no credit check once you grabbed away your vehicle loan or you funded your car thanks to good broker and didn’t rating much, you can save money by the refinancing.

?? Do not get an excellent refinance car finance if the borrowing score is leaner than just it was when you got your own new loan.

For people who re-finance that have a longer-title loan you might reduce your payment per month a lot more. Might shell out a lot more in attract and you may end up due more the car deserves.

Average Vehicles Re-finance Costs

Refinance prices are just like rates for a financial loan removed during profit, and so the rates quoted above often incorporate.

Activities That affect Your car or truck Mortgage Rates

Several affairs contribute to deciding a auto rate for brand new, utilized, and you can refinance funds. Here are four issues that helps make a difference so you’re able to the car loan speed you are provided.

step 1. Your credit rating

Automobile financing is actually safeguarded: your car or truck functions as guarantee on mortgage. For many who standard, the lending company is also repossess the vehicle. That produces your loan less risky than simply a consumer loan carry out end up being, therefore rates was less than he is for the majority unsecured financing.

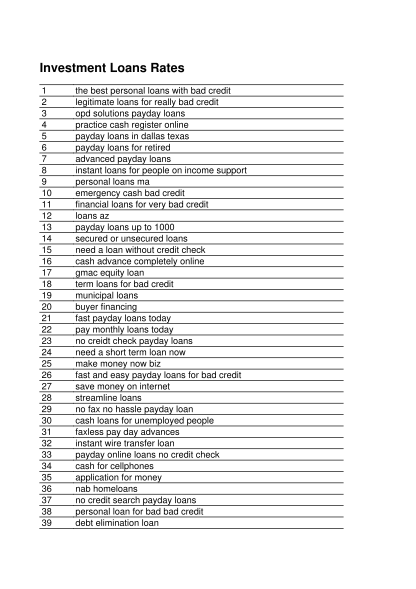

Your credit rating features a big impact on the speed you are considering and on the expense of the loan. Throughout the desk less than you will see the typical rates both for the brand new and made use of vehicles by credit rating to see exactly how much off a visible impact it has.

Actual rates of interest are derived from of a lot activities such state, down payment, income, although some. Source: Experian: State of your Motor vehicle Fund

Just how Your credit rating Has an effect on brand new Monthly payment

As you care able to see, your credit score provides a giant effect on the rate you’re given as well as on the expense of your loan. Which have a get away from 650 so you’re able to 659, you are in the bottom of diversity and can expect very high interest rates.

0 Comments