Reverse Home loan Closing costs & Charges Told me

Extremely important Notice: When you read this article clips, particular private information are taken to brand new video supplier (such as for instance YouTube, Vimeo, an such like.). For additional info on our very own confidentiality techniques, delight feedback the Privacy Observe.

Upfront Will set you back Just like a vintage forward home loan, a face-to-face home loan will demand one spend you to-big date initial will set you back at the beginning of the loan

It’s no wonders you to definitely not one person wants to pay settlement costs and you can fees. If in case considering mortgage loans, you have probably several questions regarding what this type of will set you back and charges involve. Just what are you paying for? What do a few of these various charges cover? And more than of all the, how much will it cost you?

Whether you are given a face-to-face financial , antique mortgage, or any kind of monetary unit, it is critical to enjoys an obvious comprehension of the relevant will set you back. Out-of settlement costs in order to lending fees and even relevant interest levels, you need to know exactly the amount of money you’ll need to bring to new dining table.

In the case of a home Guarantee Conversion process Home loan (HECM) , called a face-to-face financial, you will find both initial and continuing can cost you which you’ll need to imagine before you choose so you can make use of your home’s security.

However, as the an opposing mortgage comes to tapping into equity that is currently in your home, you’ve got the option to move several can cost you to your loan. Should you decide choose to play with mortgage proceeds to cover upfront will cost you, you will not need to expend all of them from the closure. Within circumstances, these types of will set you back is subtracted out of your overall contrary real estate loan continues.

Reverse Financial Guidance One which just officially fill out the job to have a reverse financial, you’re going to be expected to meet with a 3rd-team specialist authorized by the You Agency off Construction and you will Metropolitan Invention (HUD) . It session, which is generally speaking around an hour enough time, was created to help you deepen online personal loans AR your knowledge of one’s contrary home loan as well as have approaches to people left inquiries you really have. Once the counseling payment generally speaking costs up to $125, particular enterprises is also waive the fee based your financial situation. You can discover more info on opposite home loan counseling right here .

Mortgage Origination Payment Opposite mortgage lenders fees that loan origination percentage to cover the processing, underwriting, and closure of your own financing, and good HECM is no different. However, since an excellent HECM was regulators-covered, this type of origination fees is capped. So just how far might you expect it payment getting? The loan origination percentage will equivalent sometimes $2,five-hundred or 2% of earliest $2 hundred,000 of one’s residence’s appraised worthy of-any kind of are deeper-together with step 1% of your residence’s well worth over $200,000. Has actually a high worth family? Not to proper care-the fresh new Federal Homes Management (FHA) caps most of the HECM origination charges at $six,000.

Including, keep in mind that that it percentage will be discount if you don’t waived completely according to system additionally the discretion of financial. This is exactly why it’s important to compare loan providers and you can financing info.

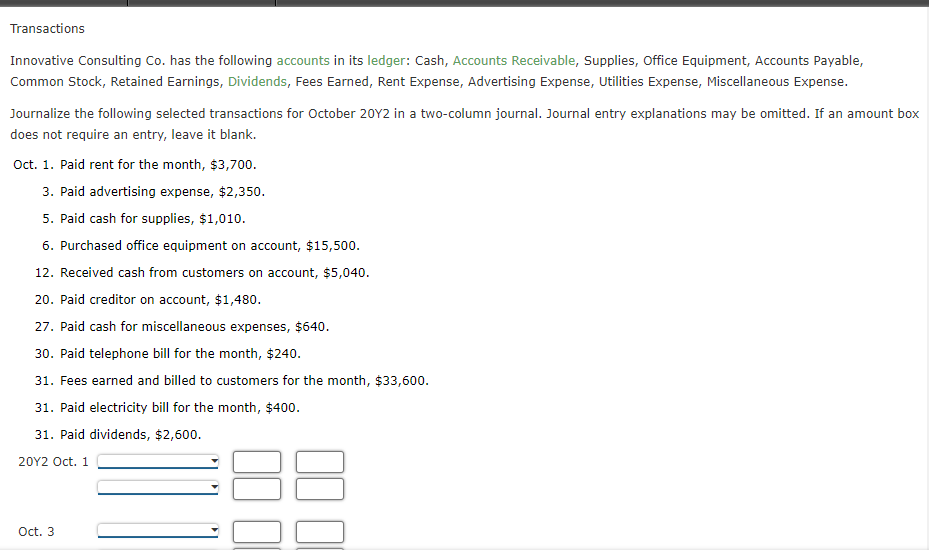

Listed below are some a number of the will set you back you are going to pay regarding the procedure of the loan

Assessment Costs Prior to your loan visits underwriting, another third-people appraiser tend to assess the value of your residence and you may assets. This appraised value is an option reason behind deciding how much cash you’ll be considered to get backwards financial proceeds. Together with respecting your home, brand new appraiser is additionally guilty of ensuring there are no health and you may protection questions with regards to your home. If your appraiser uncovers property faults, your residence may not fulfill HUD lowest property requirements. In cases like this, you’ll want to make required repairs, then keeps a take-right up review because of the appraiser. Because payment charged on the assessment varies from county so you’re able to county, the average cost is approximately $575. When the a take-up examination is necessary, you can expect they to help you rates to $125. It is vital to observe that just like the appraisals try held by an separate party, lenders don’t have control of the outcomes of your test or perhaps the exact prices. Every so often, HUD need the next appraisal too.

0 Comments